GENERALI GROUP CONSOLIDATED RESULTS AT 30 JUNE 2019 (1)

1st August 2019

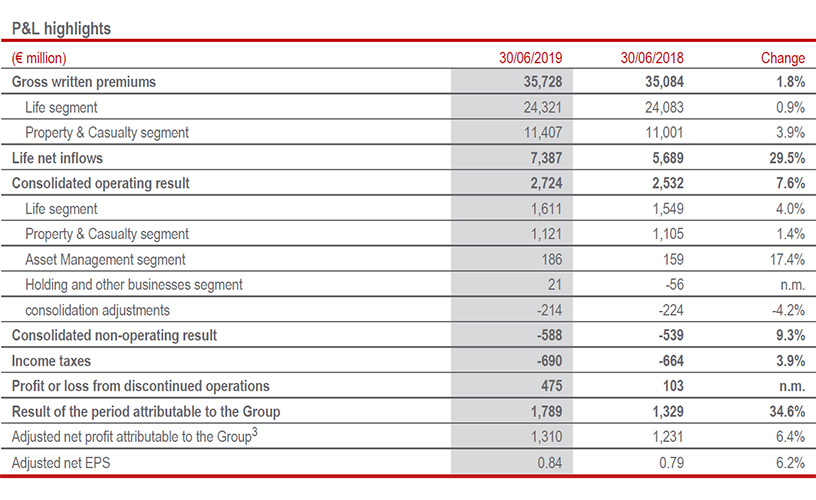

EXCELLENT OPERATING RESULT AT € 2.7 BILLION (+7.6%) AND STRONG GROWTH IN NET PROFIT TO € 1.8 BILLION (+34.6%). THE SOLID CAPITAL POSITION IS CONFIRMED

- The operating result increased thanks to positive developments in all business segments

- The Group net profit stood at € 1.8 billion (+34.6%), also including the result of discontinued operations. Adjusted net profit2 rose to € 1.3 billion (+6.4%)

- Life net inflows grew to € 7.4 billion (+29.5%) and technical reserves reached € 358 billion (+4.3%). Gross written premiums stood at € 35.7 billion (+1.8%), due to the positive performance of both Life and P&C segments

- The technical excellence of the Group is confirmed with the combined ratio at 91.8% (-0.2 pps) and the New Business Margin at 4.40% (-0.18 pps)

- Asset Management net profit stood at € 133 million (+22%), with third-party AuM in this segment rising sharply to € 102 billion

- The Preliminary Regulatory Solvency Ratio remains solid at 209% (217% FY 2018; -8 pps)

Generali Group CEO Philippe Donnet declared: “These results show the Group’s capacity to generate sustainable financial and industrial value for all of its stakeholders. The first half of the year confirms the effective and disciplined implementation of the three-year strategic plan ‘Generali 2021’ in all business segments. Generali today is an increasingly global insurance and asset management group, with technical excellence in the Life and P&C segments and distinctive expertise in asset management, allowing us to successfully overcome the competitive challenges of the sector to become lifetime partner to our customers.”

Milan. At a meeting chaired by Gabriele Galateri di Genola, the Board of Directors of Assicurazioni Generali approved the Half-Year Consolidated Financial Report 2019 of the Generali Group.

EXECUTIVE SUMMARY

The Group's half-year results highlighted an excellent performance in terms of profitability and a solid capital position, consistent with the Group’s strategy.

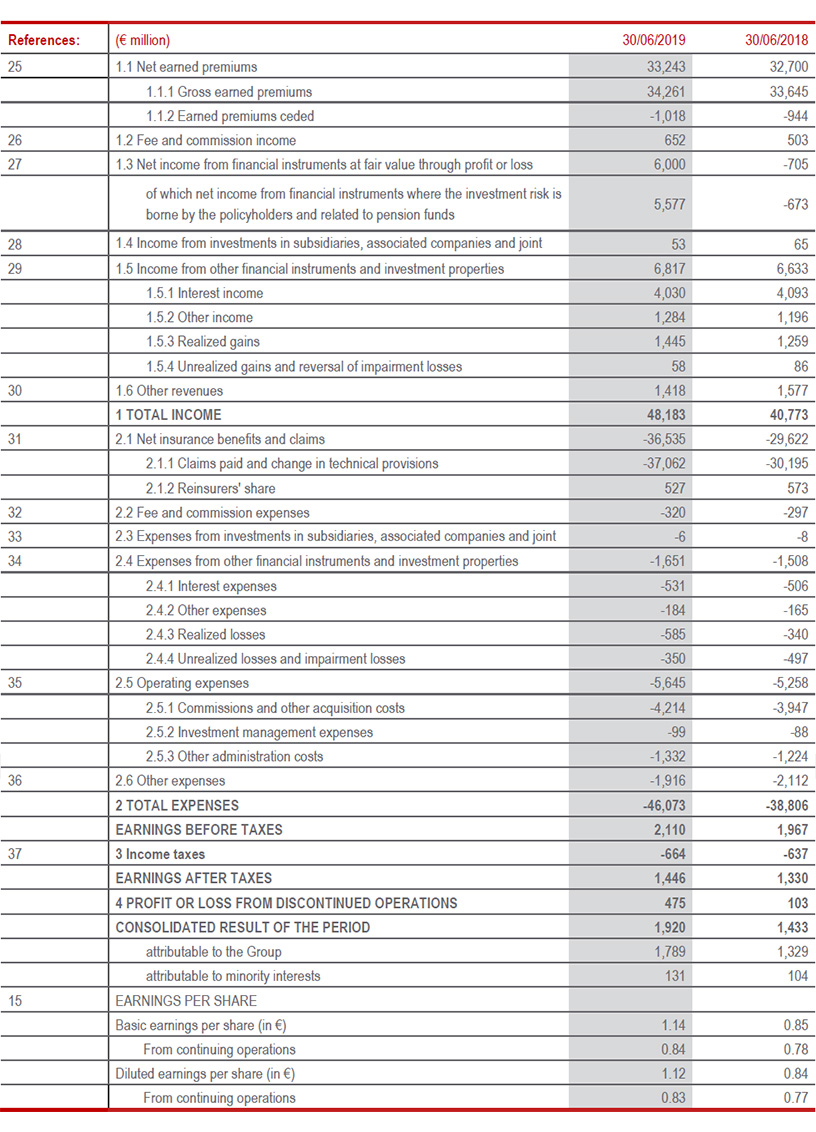

The operating result grew by 7.6% to € 2,724 million (€ 2,532 million in 1H18) thanks to positive developments in all business segments. The improvements in the Life and P&C segments were due primarily to excellent technical profitability, confirmed by the combined ratio at 91.8% (-0.2 pps), and the New Business Margin at 4.40% (-0.18 pps). The increase in the Asset Management segment was due to the growth in assets under management and the consolidation of revenues of the new asset management boutiques. The operating result of the Holding and other businesses segment benefited from the result of Banca Generali and the higher income from private equity.

The non-operating result, amounting to € -588 million, reflected a decline in financial performance due to lower realized gains, reflecting our strategy of sustaining the future returns on our investments. The lower realized gains were only partly offset by the lower impairments during the period.

There was a positive contribution from the discontinued operations. It includes a gain of € 352 million coming from the sale of Generali Leben as well as a € 128 million gain from the disposal of the Belgian business.

Net profit amounted to € 1,789 million (+34.6%), while the adjusted net profit, which does not include the impact of the above-mentioned capital gains deriving from disposals, was up by 6.4% to € 1,310 million.

The Asset Management net profit was € 133 million (+22%).

Life net inflows reached € 7.4 billion (+29.5%), with positive performances in almost all of the main countries where the Group operates. Technical reserves increased to € 358 billion (+4.3%).

Life segment premiums, amounting to € 24,321 million, increased by 0.9% thanks to the development of protection products (+9.3%, particularly as a result of growth in Germany and China, Austria, CEE & Russia - ACEER). P&C premiums increased to € 11,407 million (+3.9% on a like-for-like basis), as a result of positive developments in all the main countries where the Group operates.

The Group's total gross written premiums amounted to € 35.7 billion, up by 1.8% as a result of positive trends in both business segments.

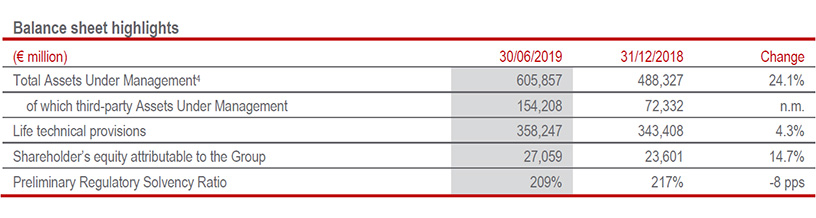

The Group’s total Assets Under Management posted an increase of 24.1% compared to 31 December 20184 reaching € 605.9 billion, due to the higher value of assets resulting from market performance and the development of third-party Assets Under Management. The latter increased by over € 154.2 billion, primarily due to the integration of new boutiques as well as the contribution of assets of a number of companies disposed of during the year, previously held by the Group and retained under the Group’s management as stipulated by the sale agreements.

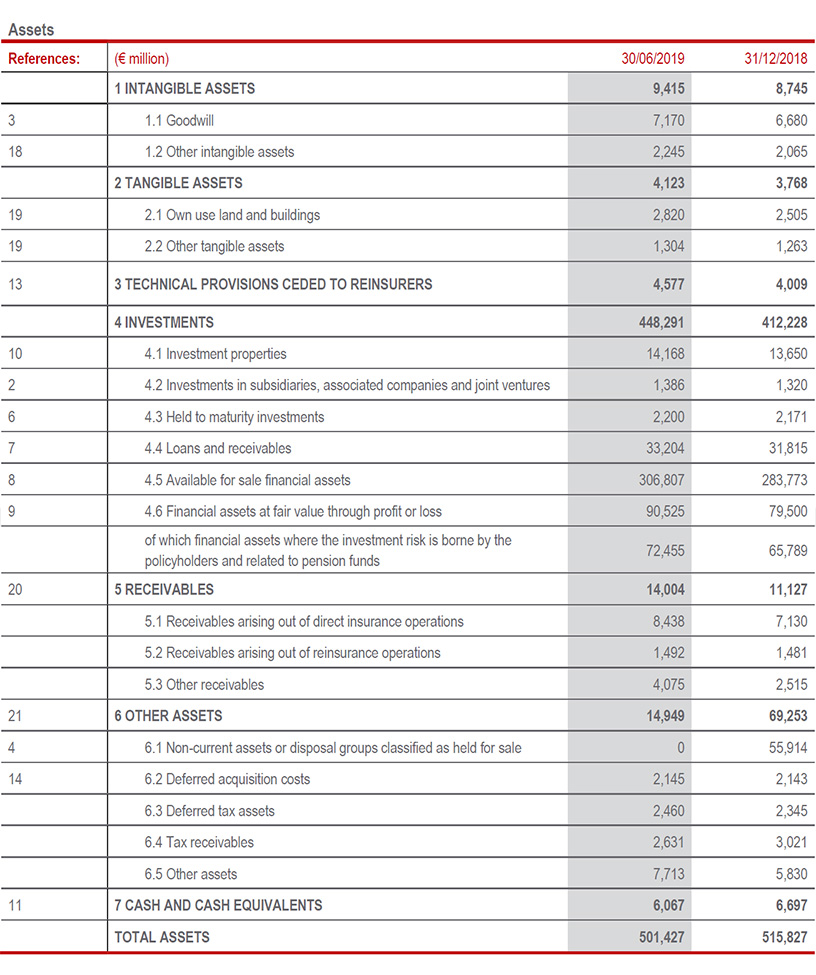

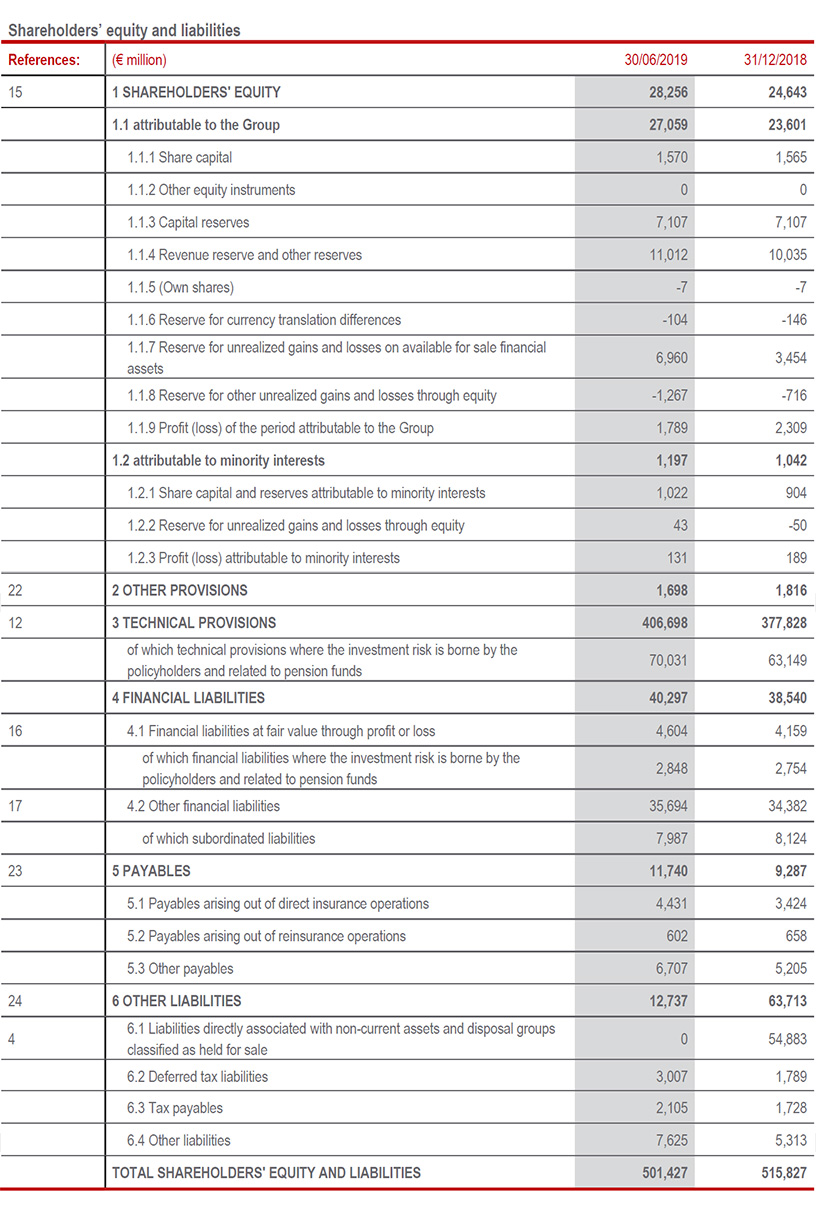

The shareholders’ equity attributable to the Group rose to € 27,059 million compared to € 23,601 million at 31 December 2018, with the increase almost entirely attributable to the higher reserve for unrealized gains and losses on available for sale financial assets, deriving mainly from the performance of our fixed income portfolio.

The Group’s solid capital position is confirmed with the Preliminary Regulatory Solvency Ratio at 209% (217% in FY 2018; -8 pps), that remains stable excluding the impact of the regulatory changes seen in the first quarter (-7 pps) and of minor model changes on the SCR (-1 pps) in the second quarter.

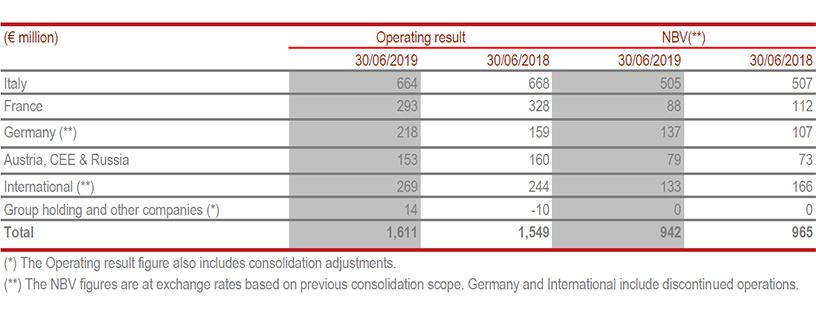

LIFE SEGMENT

- Net inflows at € 7.4 billion (+29.5%) and premiums up to € 24.3 billion (+0.9%)

- New business margin stood at 4.40% (-0.18 pps) and new business value (NBV) at € 942 million (+1.3%)

- Operating result up to € 1.6 billion (+4%)

Life net inflows increased to € 7,387 million (+29.5%), with positive performances in almost all the main countries where the Group operates. In particular, Italy benefitted from the decrease in lapses, France from increased premiums, and Asia benefitted from the combined effect of both factors.

Gross written premiums amounted to € 24,321 million (+0.9%). This performance reflected growth in the protection line (+9.3%) seen in all of the countries where the Group operates.

The savings line remained stable, whilst unit-linked product premiums fell by 8.7%, particularly in Italy - as a result of market volatility at the end of 2018 which temporarily affected customers’ risk appetite, especially in the initial allocation of hybrid products - and in France.

With reference to the main countries in which the Group operates, France (+9.2%) benefited from the increase in capital-light saving products (+18.5%) and from the good performance of the protection line. The performance in Germany was also positive (+7.1%) due to the growth of all lines of business, and in Asia (+13%) driven by protection products and from savings products. The decline seen in Italy (-9.7%) reflects a comparison with the second quarter of 2018 which benefitted from € 1.2 billion of premiums from the renewal of group savings contracts. Without considering these renewals, total premiums in Italy would have posted an increase of 2.8%.

New business in terms of PVNBP (present value of new business premiums) amounted to € 21,436 million, up by 5.4% compared to the first half of 2018. Regarding the business lines, there was an increase in savings products (+12.1%), mainly in Italy (+9.2%), France (+15%) and Germany (+40.9%). The protection products were also up (+17.7%), due to the contribution from Italy (+20.5%), Germany (+22%) and the International area (+25.3%). The premiums relating to unit-linked products decreased (-11.7%), particularly in Italy (-26.7%) and in France (-9%), as a result of financial market volatility in the second part of 2018.

New business value (NBV) was € 942 million (€ 965 million in 1H18), up 1.3% at constant scope compared to the first six months of 2018.

The profitability on PVNBP - New Business Margin - stood at 4.40% (4.50% in 1H18) decreasing by 0.18 pps at constant scope due to a less favourable business mix and the impact of financial assumptions compared to the first six months of 2018, only partly offset by the further recalibration of financial guarantees.

The operating result of the Life segment came to € 1,611 million (€ 1,549 million in 1H18). The 4% increase reflects the development of the technical margin, net of insurance operating expenses, and the positive contribution from investment results.

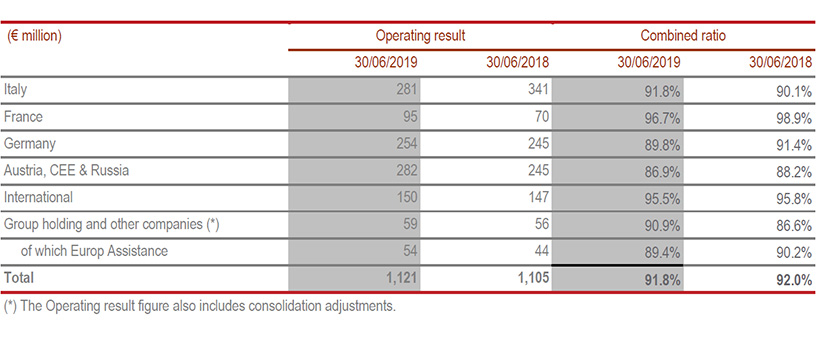

PROPERTY & CASUALTY SEGMENT

- Premiums increased to € 11.4 billion (+3.9%) both in the motor line (+3.1%) and non-motor line (+3.6%)5

- Combined ratio at 91.8% (-0.2 pps) due to the decrease in the non- catastrophe loss ratio

- Operating result increased to € 1.1 billion (+1.4%)

P&C gross written premiums continued to grow as already seen in the first quarter, increasing to € 11,407 million (+3.9% on a like-for-like basis), thanks to the development of both lines of business. Motor premiums increased by 3.1%, particularly in France (+4.2% due to new distribution partnerships), ACEER (+6.4%, seen in all countries in the area) and Americas and Southern Europe (+14.8% following inflation-related tariff adjustments).

Non-motor premiums also rose (+3.6%), reflecting the positive trends broadly extended across the Group’s various areas of operations. ACEER premiums increased in particular (+5.7%) as a result of the contribution of all countries in the area, and in Italy (+3.3%) due to widespread growth in the various businesses, especially in accident & health. Performance was also positive in France (+2.6%), supported by multi-risk policies, in Germany (+2.2%) due to the growth in Global Corporate & Commercial lines, as well as in Europ Assistance thanks in particular to the development of travel insurance.

The operating result amounted to € 1,121 million (€ 1,105 million in 1H18). The 1.4% increase is entirely attributable to improvement of the combined ratio.

The combined ratio stood at 91.8% (-0.2 pps) confirming the Group’s technical excellence in the sector. The improvement was the result of the drop in the non-catastrophe current year loss ratio in both the motor and non-motor lines of business. The impact of natural catastrophe events on the CoR remained stable at 1.4 pps compared to the first half of last year. In the first half of this year, natural catastrophe claims had a total impact of € 142 million, due mainly to the storm that hit central Europe in March and the bad weather conditions in June that affected Germany and Italy.

The expense ratio increased to 28.6%, reflecting growth in the acquisition component, mainly related to the performance of the non-motor line.

ASSET MANAGEMENT SEGMENT

The operating result of the business segment stood at € 186 million, up 17%. This performance is largely due to the increase in operating revenues, amounting to € 360 million (+25%), also as a result of the consolidation of revenues of the new boutiques.

The Asset Management segment net profit was € 133 million (+22%).

Third-party Assets Under Management in this segment rose to over € 102 billion, primarily due to integration of the new asset management boutiques, as well as the contribution of assets of a number of companies sold during the year, which remained under the Group’s management as a result of the sale agreements.

The total value of this segment’s Assets Under Management at 30 June 2019 was € 519 billion.

HOLDING AND OTHER BUSINESSES SEGMENT

The operating result of the Holding and other businesses segment was € 21 million (€ -56 million in 1H18), thanks to a greater contribution of Banca Generali due to higher performance fees, increased income from private equity and the results of the Planvital pension fund (Chile).

Net holding operating expenses totalled € -251 million (€ -233 million in 1H18), reflecting the increase in direction and coordination costs posted by a number of the Group’s territorial sub- holdings.

OUTLOOK

The first few months of 2019 saw a continued overall slowing of economic growth and trade tensions between China and the United States, as well as weakness in the economies of industrialised countries. A number of critical issues persist, such as Brexit, a general decline in interest rates, as well as an uncertain sentiment in the financial markets. In this context, the Group is effectively implementing the activities envisaged in the ‘Generali 2021’ strategic plan, whose priority is to consolidate its leadership in Europe and strengthen its position in high-potential markets, financial optimisation, innovation and the digital transformation of the operating model. In the Life segment, presentation of the strategy to rebalance the portfolio towards capital-light products continues. In the P&C segment, premiums are forecast to improve in the primary geographical areas of operation of the Generali Group, while maintaining the same levels of technical excellence with a significant focus on high growth potential markets. Lastly, in the Asset Management segment, actions will continue during 2019 to implement the strategy.

Despite the renewed pressure from rate trends, the Group confirms its targets for the next three years which forecast an increase in earnings per share of between 6% and 8%6, an average RoE of more than 11.5%7 and a target pay-out ratio between 55% and 65%8.

Significant events occurring after 30 June 2019:

An agreement was signed on July 18 for the acquisition of 100% of Seguradoras Unidas and the services company AdvanceCare in Portugal. This transaction represents an important step in executing the Group’s three-year strategy which envisages the strengthening of Generali’s leadership in Europe.

Assicurazioni Generali increased share capital to € 1,569,773,403 as a result of the special stock plan for the Managing Director/Group CEO related to the 2016-2018 term in office, approved at the 2017 Shareholders Meeting. The shares with a par value € 1.00 each, including the additional so-called “dividend equivalent” shares, will be subject to a minimum holding period as laid out in the plan’s regulation.

Details of significant events that occurred during the period and the glossary, which also includes the description of alternative performance indicators, are available in the Consolidated Half- Year Financial Report 2019 of the Generali Group.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

GROUP BALANCE SHEET AND INCOME STATEMENT 9

BALANCE SHEET

INCOME STATEMENT

1 Changes in premiums and Life net inflows are on equivalent terms (at constant exchange rates and consolidation scope) and changes in new business are at constant scope. The operating result, Assets Under Management and Life technical reserves exclude assets under disposal or disposed during the period.

2 Adjusted for the impact of gains and losses from disposals.

3 Adjusted for the impact of gains and losses from disposals.

4 The figure representing Assets under Management at the Group level at year-end 2018 excludes the entities that were to be sold or were sold in the period, in line with IFRS 5 principles.

5 The breakdown for motor/non-motor is provided on direct business.

6 Three-year CAGR; adjusted for impact of gains and losses related to disposals.

7 Based on IFRS Equity excluding OCI and on total net result.

8 Adjusted for impact of gains and losses related to disposals.

9 With regard to the financial statements envisaged by law, note that statutory audit has not been completed on the data. The Group will publish the final version of the Consolidated Half-Yearly Financial Report 2019 in accordance with prevailing law, also including the Independent Auditor’s Report.