Financial Information at 30 September 2020 - Press-Release (1)

12 November 2020

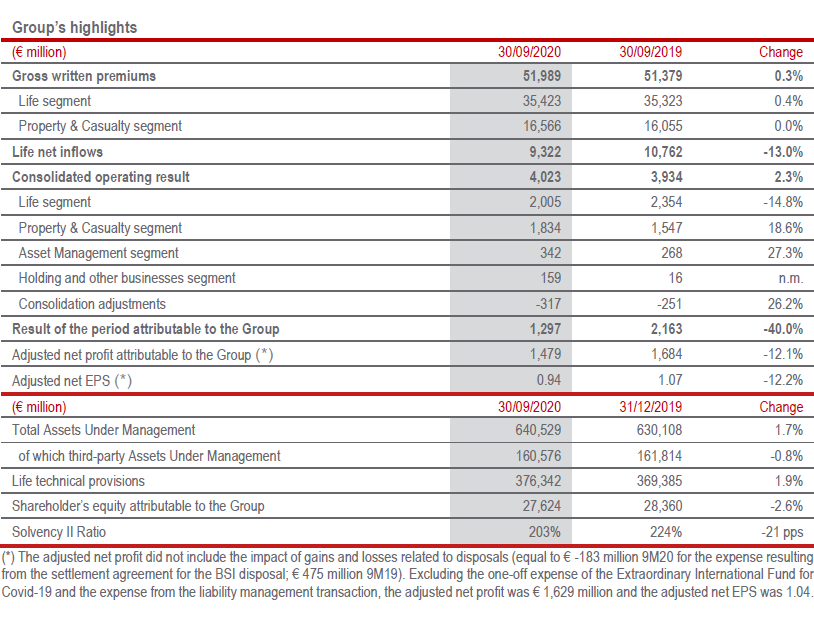

OPERATING RESULT ROSE TO € 4 BILLION (+2.3%). NET PROFIT AFFECTED BY IMPAIRMENTS ON INVESTMENTS AND NON- RECURRING EXPENSES, INCLUDING THE LIABILITY MANAGEMENT. EXCELLENT CAPITAL POSITION

- Operating result up to € 4 billion, thanks to positive development of the P&C and Asset Management segments, supported also by recent acquisitions, as well as of the Holding and other businesses segment. Technical excellence was confirmed with a Combined Ratio at 89.7% (-2.8 pps) and New Business Margin reached excellent levels (4.10%; -0.18 pps).

- Total gross written premiums reached € 52 billion (+0.3%), with resilient P&C premiums and a positive development for the Life segment (+0.4%). Life net inflows remained solid at € 9.3 billion (-13%) and Life technical provisions increased to € 376.3 billion (+1.9%).

- The Group’s capital position strengthened, with a Solvency II Ratio at 203% (+9 pps HY20).

- The Group’s net profit was € 1,297 million (-40%), affected by € 310 million in net impairments on investments related to the performance of the financial markets, € 183 million for the arbitration settlement on the BSI disposal, the contribution of € 100 million2 for the Extraordinary International Fund for the pandemic emergency and € 73 million expense from the liability management transaction. Excluding the expense of the Extraordinary International Fund for Covid-19 and the expense from the liability management transaction, adjusted net profit3 reached € 1,629 million (-13%).

Generali Group CFO, Cristiano Borean, commented: “The results for the first nine months continue to demonstrate Generali’s resilience as evidenced by the excellent technical margins supporting the operating result and capital position. In an environment that continues to be characterised by heavy macroeconomic and financial impact of the ongoing pandemic, the Group confirms its strengths based on its leadership position in Europe and a primarily retail-focused, flexible and diversified business model. Generali remains committed to be a true Lifetime Partner to its customers, through specific aid and assistance initiatives, and to support the communities where it operates, through initiatives including the Extraordinary International Fund for Covid-19.”

Milan - At a meeting chaired by Gabriele Galateri di Genola, the Board of Directors of Assicurazioni Generali approved the Financial Information at 30 September 20204.

PREMIUMS, NEW BUSINESS AND VOLUMES

- The Group’s gross written premiums amounted to € 51,989 million, showing a slight increase compared to last year (+0.3%), thanks to the contribution from the Life segment. P&C remained stable. Excluding the written premiums of a collective Life pension fund in Italy5 amounting to around € 1.5 billion, the Group’s gross written premiums would have been down by 3.9%.

Life premiums increased slightly (+0.4%): the increase in unit-linked products was significant (+24.6%), driven by the trend in Italy and Germany. Savings and pension products declined (-12.7%), mainly in Italy, France and Spain. The protection line (+1.6%)6 observed trends that were differentiated in the Group’s various countries of operations. The contribution from accepted premiums in the protection line grew thanks to a new partnership in France.

Concentrated in the unit-linked and protection lines, Life net inflows (premiums collected, net of claims and surrenders) were € 9,322 million, down 13%. The decrease was mainly due to the trend in the savings and pension line in France, which showed a reduction in premiums and higher surrenders, in line with the Group’s portfolio repositioning strategy. The countries in the International cluster contributed, albeit to a lesser extent, to the decline in net inflows. Excluding the growth in Italy resulting from the premium mentioned above, the decrease would have been 26.9%.

Against the market context, P&C premiums were stable, on equivalent terms, at € 16,566 million. The motor line observed differentiated trends across the Group’s various countries of operations, overall maintaining the same levels as in the previous year. The positive performance in ACEER and Americas and Southern Europe, also after inflationary adjustments, was offset by a 3.6% decrease in Italy due to the lockdown measures in the first half of the year. The non-motor line (+0.3%) reflected the positive trends across the Group’s areas of operations, particularly in Italy - driven by the development of policies associated with Covid-19 in the health and assistance line and that of the corporate business - ACEER, France and Spain. Europ Assistance posted a decrease (-31.5%), with premiums affected by the pandemic, particularly in the travel line of business. - New business in terms of PVNBP (present value of new business premiums) stood at € 31,599 million, up 1.3%. The above-mentioned effect in the Italian unit-linked line posted in June more than offset the decrease in savings and pension product premiums, associated with the current financial context characterised by very low interest rates. Protection products grew thanks to a significant contribution from Germany and the performance in Italy in the third quarter of the year. Excluding premiums of the above-mentioned Italian collective pension fund, new business would have been down by 6.9%.

The profitability on PVNBP stood at 4.10% (4.28% 9M19) with a 0.18 pps decrease due to a less favourable financial position than in the first nine months of 2019, partly offset by the more favourable business mix and the continuous development of new products without guarantee. Excluding the above-mentioned pension fund, profitability would have stood at 4.30%.

Consequently, new business value (NBV) was € 1,296 million (€ 1,340 million 9M19), down 2.9% compared to the first nine months of 2019. Without the value of the above-mentioned pension fund, NBV would have been € 1,250 million (-6.3%). - Total third-party Assets Under Management7 were € 160,576 million (-0.8%). Despite the financial market volatility, the improved trend compared to the first semester reflected the positive net inflows in the third quarter.

- Life technical provisions rose to € 376,342 million (+1.9%), reflecting the performance of traditional liabilities (+2.3%) and the unit-linked component (+0.4%), thanks to the positive contribution from net inflows.

ECONOMIC PERFORMANCE

- The operating result reached € 4,023 million, rising by 2.3%.

The P&C operating result increased significantly (+18.6%), benefiting from improved technical profitability and the positive contribution from the recent acquisition of Seguradoras Unidas in Portugal (€ 78 million). The decline in the investment result was due to lower current income, which reflected the current condition of market interest rates and lower dividends from equities. The Combined Ratio improved by 2.8 pps to 89.7%, largely driven by the decrease in the non-catastrophe current year loss ratio in the motor line across all the Group’s main countries of operations, also due to the impact of lockdown measures. The contribution of the prior year loss ratio decreased to -3.2 pps (-4.6 pps 9M19). The expense ratio also improved, particularly the administration cost ratio. Natural catastrophe claims in the nine months amounted to around € 213 million, equal to 1.4 pps on the combined ratio (1.7 pps 9M19).

The Life operating result decreased by 14.8%. The good performance of the technical margin, net of insurance expenses, was more than offset by the decrease in the net investment result, due to the negative impact of the financial markets - also from the impact of Covid-19 - and, to a more significant extent, to the continued acceleration of provisions for guarantees to policyholders in Switzerland, reflecting more conservative long-term financial assumptions. The operating result of the Asset Management segment grew by 27.3%, mainly boosted by operating revenues increasing to € 635 million (+15.9%), mainly thanks to a disciplined approach leveraging our multi-boutique strategy and to the performances of our partners. The operating result of the Holding and other businesses segment also improved thanks to the better result coming from Banca Generali and to the exceptional third quarter performance of private equity compared to the third quarter of last year.

Finally, the change in the consolidation adjustments was mainly due to higher intragroup dividends, mostly in the third quarter, from the real estate and private equity funds.

The Group’s operating result was estimated to be negatively impacted in the first nine months for approximately € -125 million as a result of the Covid-19 pandemic8.

In particular, the Life business was estimated to be impacted for a total of € -276 million, largely due to the lower net investment result, given the financial markets environment.

The P&C business was estimated to be positively impacted for € 94 million: higher claims directly linked to the pandemic and lower current income were more than offset by a lower loss ratio as a result of the lockdown measures in the main countries in which the Group operates, primarily in the first six months of the year.

Lastly, the operating result was estimated to be positively impacted by cost savings resulting from initiatives implemented by the Group to respond to the Covid-19 outbreak, among those the new way of working that extended smart working to over 90% of staff to ensure employee safety and led to cost savings (e.g. travel costs, expenses for events, etc.).

In addition to the initiatives carried out by the Group, the Group CEO, the members of the Group Management Committee and other managers with strategic responsibilities decided voluntarily to reduce their fixed compensation by 20% starting in April 2020 and until year end, further increasing the Extraordinary International Fund for Covid-19. - The Group’s net profit was € 1,297 million (€ 2,163 million 9M19). Considering a growing operating result, the 40% decrease was largely due to:

- the lower non-operating investment result, which went from € -351 million to € -556 million and included € 340 million in impairments9 on available for sale financial assets resulting from the negative performance of the financial markets, as well as a € 93 million impairment on goodwill related to Life business of the company in Switzerland. The non-operating investment result also included € 94 million10 in expenses from the liability management transaction of July 2020, which involved the buyback of three series of subordinated notes with an aggregate nominal amount of around € 600 million. A liability management transaction had led to € 245 million expenses in September 201911;

- the non-operating expense amounting to € 10012 million from the establishment of the Extraordinary International Fund launched by the Group to assist in the Covid-19 emergency, to support national healthcare systems and economic recovery. Local initiatives amounting to € 63 million continued to be executed in the main countries of operation in response to the Covid-19 emergency;

- the higher tax rate, which rose from 31.6% to 37.1%, mainly due to the higher impact of non-deductible expenses;

- the impact of gains and losses related to disposals of discontinued operations, amounting to € -183 million for the settlement agreement with BTG Pactual to end arbitration for the BSI disposal (€ 475 million 9M19, relating to the disposal of Generali Leben and business in Belgium).

Adjusted net profit was € 1,479 million (-12.1%). Excluding the one-off expense of the Extraordinary International Fund for Covid-19 and the above-mentioned liability management transaction, the adjusted net profit stood at € 1,629 million (-13%). - The net profit of the Asset Management segment grew to € 250 million (+32.8%), as a result of an improved operating result.

- The P&L return on investments was 1.90% (2.44% 9M19), reflecting lower current income and impairments.

BALANCE SHEET AND CAPITAL POSITION

- The Group shareholders’ equity was € 27,624 million (€ 28,360 million FY19). Given the result of the period attributable to the Group, amounting to € 1,297 million, the change of -2.6% was mainly attributable to accounting of the 2019 dividend for a total of € 1,513 million, the first tranche of which was paid in May. The Board of Directors took note of the letter received from IVASS on 10 November 2020 and therefore decided to comply with the current demands of the Regulator and consequently not to proceed with the payment of the second tranche of the 2019 dividend by year-end, although the requirements of the Risk Appetite Framework were met13.

- The Solvency II Ratio - which represents the regulatory view of the Group’s capital and is based on the use of the internal model, solely for companies that have obtained the related approval from IVASS, and on the standard formula for other companies - stood at 203%, further improving from the already solid half-yearly level.

Compared to 224% at year-end, the decline was largely due to the negative impact of market variances (-21 pps) relating to the current international economic and financial situation characterised by great uncertainty.

The very positive (+10 pps) normalised capital generation, net of the accrued dividend calculated on a pro rata basis compared to the full dividend of 2019, together with the positive effect from de-risking measures implemented in the last months, offset regulatory changes, the acquisition of Seguradoras Unidas and AdvanceCare in Portugal, extraordinary variances in the period (the agreement to settle the arbitration for the BSI disposal, the establishment of the Extraordinary International Fund for the Covid-19 emergency and the partial buyback of subordinated debt) and other variances.

In a scenario still characterised by the heavy macroeconomic and financial impact of the pandemic, which spread in the first months of the year and is recording a second wave of infections, noteworthy uncertainties remain in evaluating the overall effect on the global insurance industry.

The Generali Group, thanks to its business mix and diversification, expects that its operating result continues to be resilient in 2020, although probably lower than in 2019.

From an operational standpoint, the macroeconomic consequences of Covid-19 will have a negative impact on the evolution of the Group’s premiums, especially in travel insurance.

With regard to overall claims, following the decrease witnessed in the months of lockdown, uncertainty for the rest of the year remains. The Group is still able to count on a favourable business mix and on solid policy terms.

With the view to mitigate the impact of the forecast reduction of revenues (volumes and financial income), Generali will also continue its commitment to reduce its cost base.

In line with its ambition to be Lifetime Partner to customers and its commitment to sustainability, the Group has implemented a series of measures to support its employees, its customers, its agents and the communities where it is present. While these initiatives have an impact on our cost base and on our results in the short term, our commitment will continue because the well- being and the safety of our stakeholders are an investment for our future.

Taking into account the negative impact from the financial markets and from some non-recurring expenses in the first nine months of the year, the net result 2020 is expected to be lower than that of 2019.

Even with these uncertainties, the current environment has confirmed the validity of the Generali 2021 strategy and the foundation on which it was built, the solidity of the Group’s business model and its technical excellence.

The rigorous execution of the strategy has allowed Generali to face the first nine months of 2020 with solid fundamentals, both from an operational standpoint and in terms of its capital position and liquidity, which is confirmed at the highest level ever.

Generali will therefore continue to implement its strategy: the strong brand, underpinned by the Group’s first global advertising campaign, the disciplined approach in underwriting and the digital transformation are and will be its main distinctive characteristics. The Group’s mission to be Lifetime Partner to its customers offering them personalized solutions is even stronger under the current circumstances.

In this unprecedented moment, the entire Group remains focused on implementing the Generali 2021 strategy.

On 18 November, Generali will meet with the financial community at a digital Investor Day to provide an update on the progress of the “Generali 2021” strategic plan.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

The glossary and the description of alternative performance indicators are available in the 2019 Annual Integrated Report and Consolidated Financial Statements of the Group.

1Changes in premiums, Life net inflows and PVNBP (present value of new business premiums) were presented in equivalent terms (at constant exchange rates and consolidation scope). Changes in operating result, own investments and Life technical provisions excluded assets disposed of during the same period of comparison.

2This amount, after taxes, was € 77 million.

3The adjusted net profit did not include the impact of gains and losses related to disposals, amounting to € -183 million 9M20, deriving from the settlement agreement for the BSI disposal (€ 475 million 9M19, relating to the disposal of Generali Leben and business in Belgium).

4The Financial Information at 30 September 2020 is not an Interim Financial Report according to the IAS 34 principle.

5In June 2020, Generali Italia was awarded the management mandate for two investment segments of Cometa, the National Supplementary Pension Fund for employees in the engineering, system installation and similar industries and for employees in the gold and silver industries.

6The change in the protection line of business was calculated on 9M19 figures restated so as to take into account an allocation among the various lines of business that was more consistent with the characteristics of certain products in China.

7Including also assets managed by Banca Generali and pension funds.

8The current uncertain environment makes it very difficult to evaluate the overall impact of the pandemic, both in the present and in the future. Please refer to the ‘Impact on the Group’s business’ section in the Half-Yearly Consolidated Financial Report 2020 for more information on the methodology used to determine quantitative impacts.

9The Financial Information at 30 September 2020 is not an Interim Financial Report according to the IAS 34 principle. Therefore, 3Q20 impairments did not reflect a permanent change in the carrying value of these investments, which will be determined on 31 December, based on the asset values at that time. The impact on net result of operating and non-operating impairments was € 310 million.

10This amount, after taxes, was € 73 million.

11This amount, after taxes, was € 188 million.

12This amount, after taxes, was € 77 million.

13Please read the press release on dividend issued on 12 November 2020 for further information.