Financial Information as of 31 March 2021 – Press Release (1)

18 May 2021

EXCELLENT BUSINESS PROFITABILITY, WITH STRONG GROWTH IN OPERATING RESULT AND NET RESULT. THE CAPITAL POSITION WAS EXTREMELY SOLID

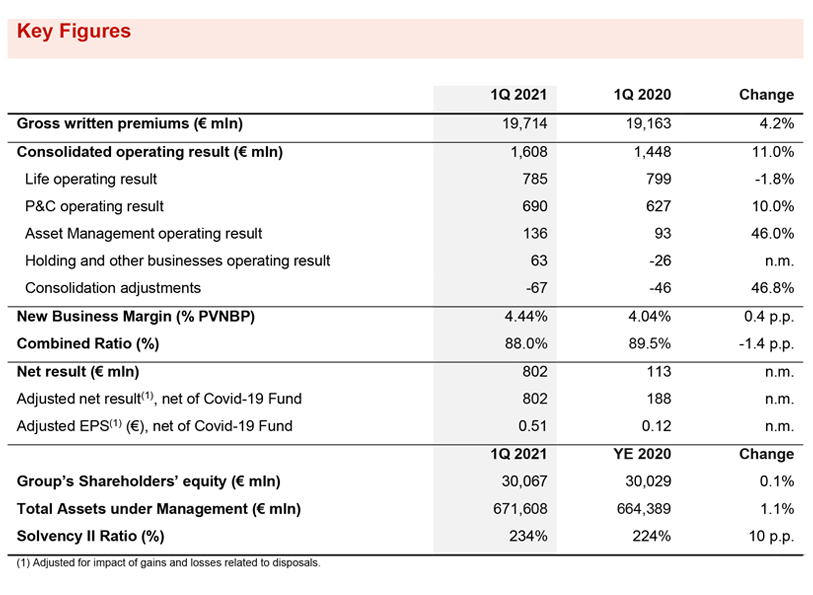

- Operating result stood at € 1.6 billion (+11%), thanks to the positive development of the P&C, Asset Management and Holding and other businesses segments. The contribution from the Life segment was resilient

- Gross written premiums reached € 19.7 billion (+4.2%), up in both the Life segment (+5.5%) and the P&C segment (+1.9%). Life net inflows increased to € 3 billion (+1%), fully concentrated in the unit-linked and protection lines. The Combined Ratio was 88.0% (-1.4 p.p.) and the New Business Margin was excellent, and at 4.44% (+0.4 p.p.), among the best in the sector

- Net result rose to € 802 million (€ 113 million 1Q2020), also reflecting the operating result. The first quarter of 2020 was impacted by significant impairments on investments and the expense of the Extraordinary International Fund for Covid-19

- The capital position was extremely solid, with the Group’s Solvency Ratio at 234%, benefitting from excellent capital generation and positive market performance

The Generali Group CFO, Cristiano Borean, stated, “The Group closed the first quarter of 2021 with a great performance in line with its targets, confirming the effectiveness of the ‘Generali 2021’ strategy. The Group remains among the most solid in the insurance sector, with an excellent capital position. The rebalancing of the Life business mix is well under way and has enabled us to maintain excellent profitability in the current low interest rate environment. Generali continues to post the best, least volatile Combined Ratio among its peers and has achieved impressive results in Asset Management and other segments. The strong growth in operating result and net profit demonstrate that the Group continues to operate effectively in a macroeconomic context that is still facing uncertainty due to the pandemic.”

EXECUTIVE SUMMARY

Milan - At a meeting chaired by Gabriele Galateri di Genola, the Board of Directors of Assicurazioni Generali approved the Financial Information at 31 March 20212.

The Group's gross written premiums increased by 4.2% to € 19,714 million, supported by the development of the Life segment as well as the recovery in the P&C segment. Life net inflows, fully concentrated in the unit-linked and protection lines, returned to growth, reaching € 3 billion (+1%). Life technical provisions grew to € 386 billion (+0.4%). Adjusting for the effect of the deconsolidation of a pension fund in the countries of Central and Eastern Europe, the growth in Life technical provisions would have amounted to 1.5%.

The Group's operating result rose to € 1,608 million (+11%), benefitting from the positive development from the P&C, Asset Management and Holding and other businesses segments. The contribution of the Life segment was resilient.

The Group also confirmed its outstanding technical profitability, with the Combined Ratio improving to 88.0% (-1.4 p.p.) and the New Business Margin to 4.44% (+0.4 p.p.).

The operating result of the Asset Management segment continued to grow, mainly driven by the rise in operating revenues. The operating result of the Holding and other businesses segment also continued to increase, thanks to private equity and to the significant contribution of Banca Generali.

The Group's non-operating result was € -275 million (€ -993 million 1Q2020), of which € -19 million related to the non-operating investment result. The significant improvement was thanks to the lower impairments on investments classified as available for sale. The first quarter of 2020 was also impacted by the one-off expense of € 100 million for the Extraordinary International Fund for Covid-19. The impact of interest expenses on financial debt further improved, as a result of the debt optimisation strategy.

Therefore, the net profit increased to € 802 million (€ 113 million 1Q2020)3, also reflecting the lower tax rate, which decreased from 61.2% to 31.4%. In comparison, the first quarter of 2020 was affected by several non- deductible expenses.

The Group's Total Assets Under Management reached € 671.6 billion (+1.1%).

The Group's shareholders' equity was substantially stable at € 30,067 million (+0.1%).

The Group’s capital position was extremely solid, with the Solvency Ratio at 234%. The improvement on the year-end of 2020 (224%) was thanks to positive economic variances in the period (such as, the recovery of interest rates, the narrowing of spreads on Italian sovereign bonds and the upswing in equity markets) and to the excellent contribution of normalised capital generation, net of the accrued dividend of the quarter (calculated on a pro rata basis compared to the dividend of the previous year). The normalised capital generation remained at the outstanding levels of 2020 and offset the impacts of regulatory changes at the beginning of the year (linked to EIOPA change on the Ultimate Forward Rate and the reference portfolio).

LIFE SEGMENT

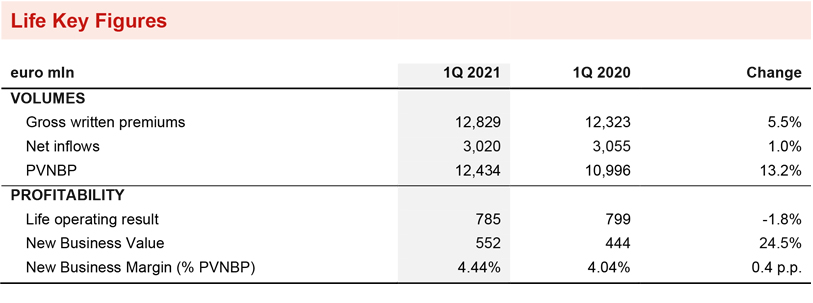

- Life net inflows up to € 3 billion (+1%), fully concentrated in the unit-linked and protection lines, in line with the Group’s strategy

- The New Business Margin was confirmed at an excellent level at 4.44% (+0.4 p.p.) and the New Business Value (NBV) grew to € 552 million (+24.5%)

- The operating result amounted to € 785 million (-1.8%)

Life net inflows increased to € 3 billion, up by 1% supported by the trends observed in France, Spain and Asia. The Group’s net inflows were fully concentrated in the unit-linked and protection lines.

Gross written premiums grew by 5.5% to € 12,829 million, mainly driven by the growth in the unit-linked line (+21%), especially in Italy and France and, to a lesser extent, the protection business (+1.2%), concentrated in Asia, Italy and ACEER. The savings and pension business decreased (-2.6%), with diversified trends in the Group's various countries of operation.

New business (expressed as the present value of new business premiums - PVNBP) rose to € 12,434 million, up by 13.2%. The increase was mainly thanks to the growth in unit-linked products (+23.1%) and protection products (+26.1%), in line with the Group's current strategy. Traditional savings products grew slightly (+2%). Despite less favourable financial assumptions, the New Business Margin came to 4.44%, posting an increase of 0.4 p.p., benefitting from the rebalancing of the business mix towards more profitable business lines and the continuous improvement in the features of new products.

The joint effect of the increase in volumes and margins resulted in a significantly improved New Business Value (NBV), amounting to € 552 million (+24.5%).

The operating result amounted to € 785 million (€ 799 million 1Q2020). The net investment result improved compared with the first quarter of 2020, which was affected by the negative performance of financial markets and the provisions for guarantees to policyholders in Switzerland. That improvement was more than offset by the decrease in the technical margin net of insurance expenses, that increased in the acquisition component. The technical margin was estimated to be impacted for € -27 million following the Covid-19 pandemic4, in particular for higher claims in the pure risk and protection lines, mainly in France, ACEER and Germany.

P&C SEGMENT

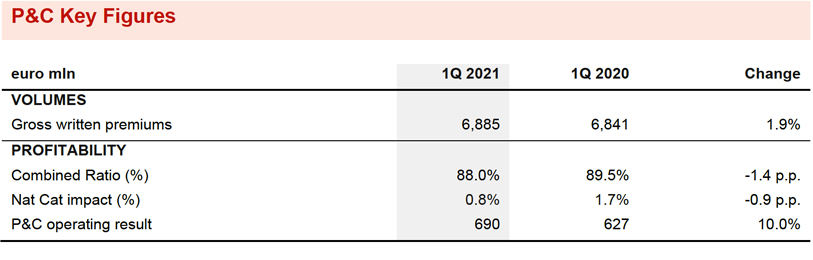

- Premiums rose to € 6,885 million (+1.9%)

- The Combined Ratio improved to 88.0% (-1.4 p.p.)

- The operating result was up by 10% at € 690 million

Premiums in the P&C segment increased by 1.9% to € 6,885 million.

On a business lines level, the motor line (+1.9%) was mainly driven by the positive development of premiums in ACEER, Italy and Argentina (also following adjustments for inflation). The non-motor line grew by 1.5%, spread throughout the various areas of the Group's operations. Europ Assistance was down (-26.3%), especially in the travel line, due to the pandemic restrictions.

The operating result of the P&C segment rose to € 690 million. The increase of 10% reflected the development of the technical result, while the investment result remained stable.

The Combined Ratio improved to 88.0% (-1.4 p.p.), confirming its position as the best and least volatile among peers. The non-catastrophe current year loss ratio decreased, due to the lockdown effects in the main countries where the Group operates compared to the first quarter of 2020 which was only partly affected by the pandemic. The impact of natural catastrophe claims decreased to 0.8% (1.7% 1Q2020). The contribution from prior years remained substantially stable.

The expense ratio increased, reflecting the 0.7 p.p. growth in the acquisition costs component.

The Group estimated its Combined Ratio excluding Covid-19 impacts to be 89.7%5.

ASSET MANAGEMENT SEGMENT

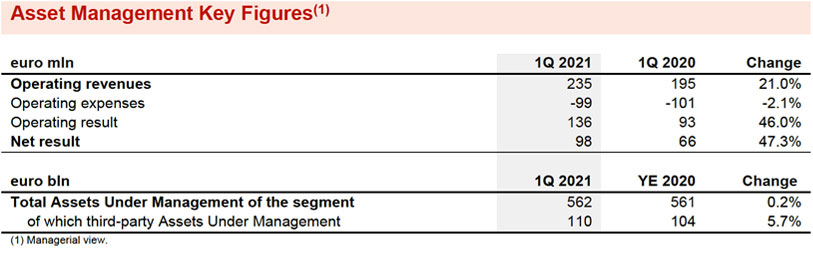

- The operating result of the segment rose to € 136 million (+46%), reflecting growth in revenues

- The net profit of the segment was € 98 million (+47.3%)

The operating result of the Asset Management segment grew to € 136 million (+46%), boosted mainly by the increase in operating revenues which reached € 235 million (+21%) - resulting from the positive contribution from all the Asset Management companies and the boutiques’ performance - including € 13 million in performance fees.

The net result of the Asset Management segment grew to € 98 million (+47.3%), as a result of an improved operating result.

Third-Party Assets Under Management rose from € 104 billion at the end of 2020 to € 110 billion in the first quarter of 2021, thanks to around € 7.6 billion in net inflows, more than offsetting a market effect of € -1.6 billion on the assets managed.

The value of the Total Assets Under Management of the segment was € 562 billion at 31 March 2021, stable compared to 31 December 2020.

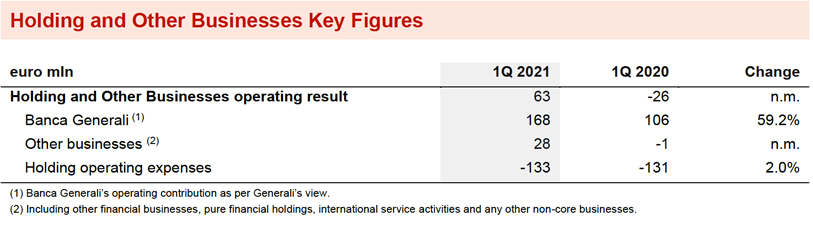

HOLDING AND OTHER BUSINESSES SEGMENT

- The operating result of the segment increased to € 63 million

- The significant contribution from Banca Generali and private equity continued

The operating result of the Holding and other businesses segment reached € 63 million (€ -26 million 1Q2020). In particular, Banca Generali's result rose to € 168 million (+59.2%) also thanks to the trend in performance fees. Other businesses also provided a positive contribution, reflecting the excellent results of private equity.

Holding operating expenses grew slightly to € -133 million (+2%).

OUTLOOK

A recovery of the global economy in 2021 is expected in the current scenario following the spread of vaccines, with positive impacts for the insurance sector as a whole. The demand for Life insurance products, while recovering, will remain lower as households continue to be cautious both in terms of investment and consumption. P&C premiums are expected to increase, at higher rates than those prior to the pandemic.

In this context, the Group confirms that it will continue with the strategy of rebalancing the Life portfolio to further strengthen profitability and with a logic of more efficient capital allocation. In P&C, Generali’s objective is to maintain the upswing trend of premium income, combined with outstanding profitability in the mature insurance markets in which the Group is present, and at the same time, strengthen its position in high growth potential markets by expanding its presence and offer.

In the course of 2021, with reference to the Asset Management segment, the Group will continue to identify investment opportunities through the expansion of the multi-boutique platform in order to increase its offering in terms of real assets, high convictions and multi-asset strategies for customers and partners.

Leveraging on all these initiatives and in light of the results achieved in 1Q2021, the Group confirms the objective of a 2018-2021 compound annual growth in earnings per share between 6% and 8%. RoE for 2021 is expected to be greater than 11.5%. Generali confirms the 2019-2021 cumulative dividend payment of € 4.5- 5 billion, subject to the regulatory context.

The glossary and the description of the alternative performance indicators are available in the Annual Integrated Report and Consolidated Financial Statements 2020.

Q&A CONFERENCE CALL

The Group CFO, Cristiano Borean, will participate to the Q&A session conference call for the Financial Information at 31 March 2021, which will be held on 18 May 2021, at 12.00 pm. CEST.

To follow the conference call, in a listen only mode, please dial +39 02 802 09 27.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

1Changes in premiums, Life net inflows and PVNBP (present value of new business premiums) were presented in equivalent terms (at constant exchange rates and consolidation scope). Changes in operating result, own investments and Life technical provisions excluded any assets disposed of during the same period of comparison.

2The Financial Information at 31 March 2021 is not an Interim Financial Report according to the IAS 34 standard.

3In the two periods of comparison the net result equalled the adjusted net result (defined as net result without the impact of gains and losses related to disposals, that was nil in both quarters). The adjusted net profit 1Q2020 also excluding the expense for the Covid-19 Fund came to € 188 million.

4For more information on the methods used to determine the quantitative impacts, see the section ‘Disclosure on the quantitative impacts of Covid-19 on the Group’ in the Annual Integrated Report and Consolidated Financial Statements 2020.

5For more information on the methods used to determine the quantitative impacts, see the section ‘Disclosure on the quantitative impacts of Covid-19 on the Group’ in the Annual Integrated Report and Consolidated Financial Statements 2020.