Financial Information as of 31 March 2023(1)

25 May 2023

Generali delivers strong profitable growth and confirms its extremely solid capital position

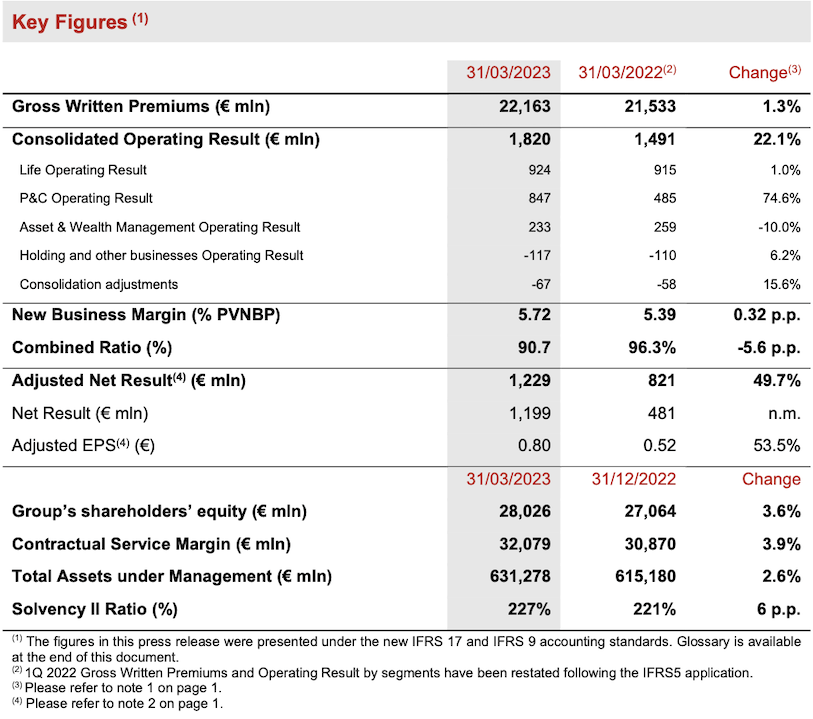

- Gross written premiums increased to € 22.2 billion (+1.3%) driven by robust growth in P&C segment (+10.1%). Life net inflows were entirely focused on unit-linked and protection, consistent with the Group’s strategy

- Operating result rose to € 1,820 million (+22.1%), mainly thanks to the strong contribution from the P&C segment, while the Life segment was resilient. The Combined Ratio improved to 90.7% (-5.6 p.p.). Excellent New Business Margin at 5.72% (+0.32 p.p.)

- Adjusted net result2 grew substantially to € 1,229 million (+49.7%), reflecting the benefit of diversified profit sources

- Extremely solid Solvency Ratio at 227% (221% FY 2022)

Generali Group CFO, Cristiano Borean, said: “The strong profitable growth delivered in the first quarter confirms that we remain fully on-track to meet the targets of our ‘Lifetime Partner 24: Driving Growth’ strategy. The performance of the P&C segment reflects our focus on technical excellence, while in the Life segment we continue to rebalance our business mix towards our more profitable lines, even in a challenging environment. The Group also confirms its extremely solid solvency position, driven by strong organic capital generation.

This quarter is also the first time that we report under the new accounting standards. This allows us to significantly improve the visibility and predictability of profit sources and provides a more accurate representation of the value embedded in our Life business. I would like to thank all the colleagues in the Group that have contributed to the IFRS 17 and 9 project.”

Executive summary

Milan - At a meeting chaired by Andrea Sironi, the Assicurazioni Generali Board of Directors approved the Financial Information at 31 March 20233 of the Generali Group.

The Group’s gross written premiums increased by 1.3% to € 22,163 million thanks to the robust growth in the P&C segment. Life net inflows were € -190 million, with net outflows from savings that were partially compensated by positive net inflows in both unit-linked and protection. This is in line with the Group’s strategy to reposition its portfolio and it also reflects the industry trends observed in the banking channels in Italy and France.

The operating result increased to € 1,820 million (+22.1%), thanks primarily to the contribution from the P&C segment.

The Life operating result was solid at € 924 million (+1.0%) and the New Business Margin increased to 5.72% (+0.32 p.p.).

The operating result of the P&C segment increased to € 847 million (+74.6%). The Combined Ratio improved to 90.7% (-5.6 p.p.), driven by a lower loss ratio.

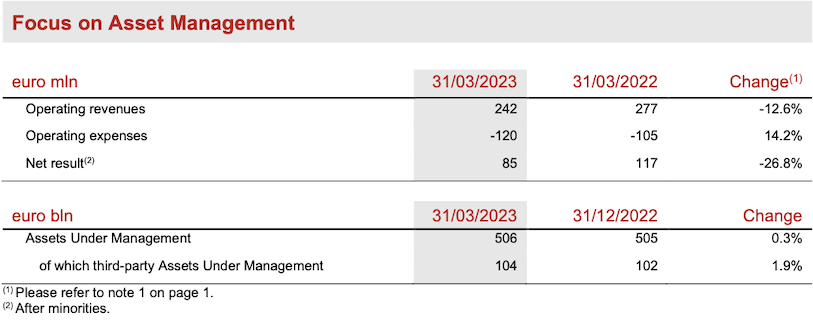

The operating result of the Asset & Wealth Management segment was € 233 million (-10.0%), with a strong improvement from Banca Generali. The Asset Management result was affected by a strong 1Q 2022 comparison basis.

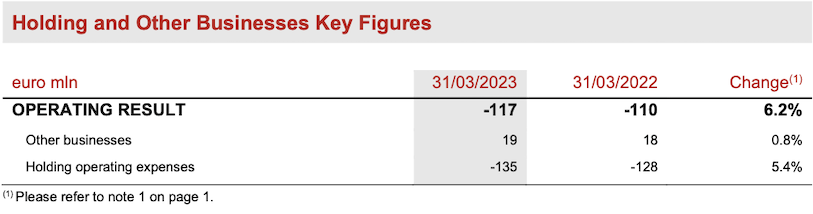

The operating result of the Holding and other businesses segment was € -117 million (+6.2%).

As announced in December 2022, the Group has introduced a new definition of the adjusted net result to better reflect the underlying business dynamics, effective from the first quarter of 2023. The following elements are normalised: the volatility stemming from the mark to market of assets at Fair Value through Profit and Loss held in non-participating business and shareholders’ funds, the application of hyper-inflation accounting under IAS 29, the amortisation of intangibles related to M&A transactions, as well as gains and losses from acquisitions and disposals.

The adjusted net result substantially increased to € 1,229 million (€ 821 million 1Q 2022). This was due primarily to the improved operating result, which benefitted from diversified profit sources, a non-recurring capital gain related to the disposal of a London real estate development (€ 193 million net of taxes), and it also reflects the impact from € 96 million in impairments on Russian fixed income instruments recorded during the first quarter of 2022.

The net result improved to € 1,199 million (€ 481 million 1Q 2022).

The Group’s shareholders' equity increased to € 28.0 billion (+3.6% compared to FY 2022), thanks to the net result for the period.

The Contractual Service Margin (CSM), which is the balance sheet liability introduced by IFRS 17 and which consists of the deferred discounted future profits of the in-force business, amounted to € 32.1 billion

(€ 30.9 billion FY 2022).

The Group's Total Assets Under Management increased to € 631.3 billion (+2.6% compared to FY 2022), reflecting the positive market effect across the main asset classes.

The Group confirmed its extremely solid capital position, with the Solvency Ratio at 227% (221% FY 2022). The 6 p.p. increase mainly reflected the strong contribution of the normalised capital generation, and also benefitted from positive impacts from market variances (driven by the narrowing of spreads on government bonds, the recovery of the equity market and the reduced volatilities). These contributions more than offset the impacts stemming from the dividend provision for the quarter and the share buyback linked to the Group’s long-term incentive plan.

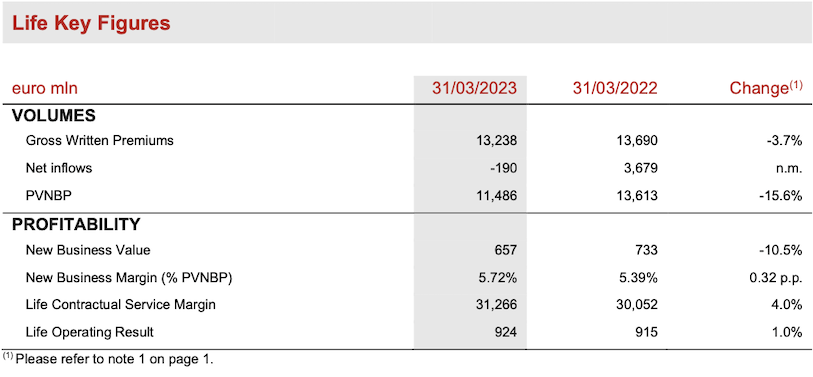

Life Segment

- Operating result stood at € 924 million (+1.0%)

- Excellent New Business Margin at 5.72% (+0.32 p.p.)

- New Business Value (NBV) was € 657 million (-10.5%)

Gross written premiums in the Life Segment4 amounted to € 13,238 million (-3.7%). The unit-linked line was down (-17.4%), driven by Italy, Germany and France. The protection line confirmed its healthy growth trajectory (+6.4%), driven in particular by France and International. The savings line was down slightly (-1.2%), with positive trends in Germany and Asia offset by the dynamics seen in Italy and France.

Life Net inflows were € -190 million. The protection and unit-linked lines recorded positive net inflows, with protection inflows reaching € 1,333 million, led by Italy and International, and with the unit-linked line at € 1,449 million, demonstrating its resilience compared with the broader insurance market.

New business (expressed in terms of the present value of new business premiums - PVNBP) was € 11,486 million (-15.6%), reflecting the economic context and the interest rates evolution, which affected the new business production in all main areas. This effect was also amplified by the higher impact of discounting on future premiums. The trends were visible in the unit-linked and saving businesses (-27.0% and -14.9% respectively), while the protection line remained very resilient (+1.0%).

The New Business Margin on PVNBP stood at an excellent 5.72%, increasing by +0.32 p.p. compared to 1Q 2022. This reflected a marked improvement in the underlying new business profitability, thanks to the quality of the product mix and the increase of interest rates.

The trends recorded on the volumes side offset the higher profitability, resulting in a New Business Value (NBV) of € 657 million (-10.5%).

The Life Contractual Service Margin (Life CSM) increased during the quarter to € 31,266 million from

€ 30,052 million at FY 2022. This was thanks to € 824 million Life New Business CSM and reflected the release of the Life CSM for € 743 million. The latter also represents the main driver (almost 80%) to the Life operating result, which stood at € 924 million (€ 915 million 1Q 2022).

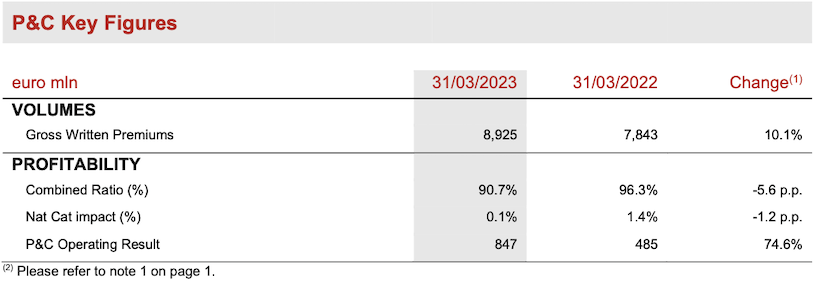

P&C Segment

- Premiums increased to € 8,925 million (+10.1%)

- Combined Ratio improved to 90.7% (-5.6 p.p.)

- Operating result rose to € 847 million (+74.6%)

P&C gross written premiums grew to € 8,925 million (+10.1%) boosted by the performance of both business lines.

Non-motor improved strongly (+12.1%), achieving widespread growth across all main areas. Europ Assistance premiums grew by 55.7%, thanks to the continued volume expansion in the travel business.

The motor line rose by 9.2%, thanks to the positive dynamics seen in Italy, France, CEE and Argentina. Excluding the contribution from Argentina, a country impacted by hyperinflation, total motor line premiums increased by 4.8%.

The Combined Ratio was at 90.7% compared to 96.3% in the first quarter of 2022. This was the result of an improvement in the loss ratio to 60.6% (-7.2 p.p.), partly compensated by a higher expense ratio at 30.1% (+1.6 p.p.). The positive dynamics in the loss ratio benefitted from a benign natural catastrophe loss ratio of 0.1%, which is 1.2 p.p. lower than 1Q 2022, and from a higher discounting impact. The impact from large

man-made claims increased by 0.7 p.p.. The positive contribution from prior year development stood at -2.0% which is 1.9 p.p. better than 1Q 2022, a quarter that was also affected by inflation-related reserves strengthening.

The undiscounted combined ratio – which excludes the discounting effect from claims reserved – improved to 93.8%, from 97.4% at 1Q 2022.

The operating insurance service result was € 669 million (€ 233 million in 1Q 2022) benefitting from € 223 million of discounting effect compared to € 70 million at 1Q 2022, leading to an undiscounted insurance service result of € 446 million. The investment result was € 178 million (-29.2%), reflecting higher finance expenses, primarily driven by the rise in interest rates during 2022.

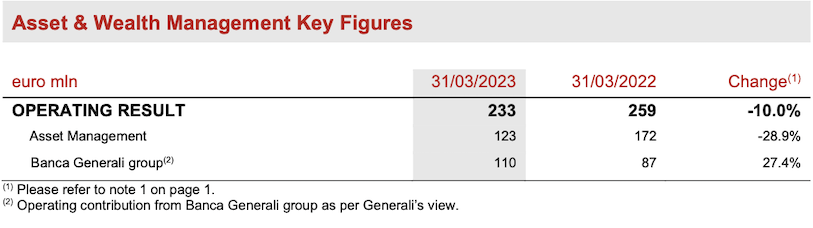

Asset & Wealth Management Segment

- Asset Management operating result was € 123 million (-28.9%), primarily reflecting the lower AUM base and lower non-recurring performance fees

- Banca Generali group operating result rose to € 110 million (+27.4%), thanks to business diversification and the improvement in margins

The operating result of the Asset & Wealth Management segment stood at € 233 million (-10.0%). In particular, the operating result of Asset Management activities was € 123 million (-28.9%). This reflected both the development of recurring fees to € 206 million (-5.2%), following the market effect on average Assets Under Management over the course of 2022, and the comparison with 1Q 2022, during which the segment recorded non-recurring performance fees of € 38 million. Transaction fees originating from real estate and infrastructure investments at 1Q 2023 amounted to € 16 million. Operating expenses rose to € 120 million (+14.2%), including the launch of initiatives aimed at optimising operations.

The operating result of the Banca Generali group rose to € 110 million (+27.4%), thanks to the diversification of the business that enabled it to capture opportunities emerging in the market in 1Q 2023. The performance was also supported by the improvement in the net interest margin coupled with disciplined cost management.

Total net inflows at Banca Generali in 1Q 2023 were € 1.5 billion, confirming the strong commercial development of volumes.

The net result of the Asset Management segment was € 85 million (-26.8%).

The total value of the Assets Under Management managed by the Asset Management companies was € 506 billion (+0.3% compared to FY2022). Third-party Assets Under Management managed by the Asset Management companies grew to € 104 billion (+1.9% compared to FY2022). The change was driven by the positive trends in financial markets during the quarter and by net inflows from third-party customers amounting to € 144 million.

Holding and other business Segment

- Operating result was € -117 million (+6.2%)

The operating result of the Holding and other businesses segment reached € -117 million (€ -110 million 1Q 2022). The contribution from Other businesses was stable at € 19 million. Holding operating expenses were € 135 million, growing by 5.4% compared to the 1Q 2022.

Outlook

In early 2023, some economic indicators, including European labour market data, pointed towards mitigating factors for a possible slowdown of the global economy. Inflation readings and central bank comments at the beginning of 2023 have raised expectations on short term interest rates. At the same time, the economic impact from the US regional banks’ fragility that had emerged at the beginning of March remains to be assessed. During the first half of 2023, government bond yields are expected to stay around the levels observed in the second half of 2022, before receding later in the year as inflation worries gradually subside. The implications of the macroeconomic situation described above could affect the global insurance sector.

Generali confirms the continued rebalancing of its Life portfolio to further increase its profitability, with more efficient capital allocation. Simplification and innovation will continue to be key, with the introduction of a range of modular product solutions, designed for the specific requirements and new needs of customers, and marketed through the most suitable, efficient and advanced distribution channels. In the P&C segment, the Group’s objective for the mature insurance markets is to maximise profitable growth, primarily in the non-motor line, and to continue to gain further ground in high growth potential markets by expanding its presence and offer. Given the current inflation dynamics, the Group plans further pricing adjustments, in addition to those already undertaken. In the Asset & Wealth Management segment, the activities identified in the Group’s strategic plan will continue to be implemented, with the aim of extending the product catalogue and enhancing distribution competences.

With these clear priorities identified and thanks to the results achieved, the Group confirms all targets of its ‘Lifetime Partner 24: Driving Growth’ strategic plan. This is focussed on strong financial performance, best-in-class customer experience and an even greater social and environmental impact, delivered by all of Generali’s employees. The Group intends to pursue sustainable growth, enhance its earnings profile and lead innovation to achieve a compound annual growth rate for earnings per share5 between 6% and 8% in the period 2021-2024, to generate net holding cash flow6 exceeding € 8.5 billion in the period 2022-2024 and to distribute cumulative dividends to shareholders for an amount between € 5.2 billion and € 5.6 billion in the period 2022-2024, with a ratchet policy on dividend per share.

Significant events after 31 March 2023

On 20 April, Generali announced a liability management transaction, with the successful conclusion of the buyback of € 499,563,000 of perpetual notes and the € 500,000,000 placement of its fourth green bond.

On 4 May, Generali reached an agreement with Frankfurter Leben for the disposal of Generali Deutschland Pensionskasse AG, subject to regulatory approval. The transaction, in line with Generali’s ‘Lifetime Partner 24: Driving Growth’ strategy, will add approximately 1 p.p. to the Group Solvency II ratio.

Other significant events that occurred after the end of the period are available on the website.

Q&A conference call

The Group CFO, Cristiano Borean, and the Group General Manager, Marco Sesana, will host the Q&A session conference call for the results of the Generali Group at 31 March 2023, which will be held on 25 May 2023, at 12.00 pm CEST.

To follow the conference call, in a listen only mode, please dial +39 02 8020927.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

IFRS 17 glossary

Combined ratio (CoR): represents a profitability indicator of the P&C segment

The numerator includes

- the insurance service expenses (total incurred claims and insurance expenses)

- the other operating income and expenses and

- the result of reinsurance held.

The denominator consists of the insurance contract revenues (gross of reinsurance held).

Undiscounted Combined ratio: excludes the discounting effect from claims reserved.

Contractual Service Margin (CSM): insurance liability representing the unearned future profits from the in-force business.

CSM release: refers to the amount of CSM liabilities recognised to profit or loss in line with the service provided during the reporting period.

Life operating result: the result of the Life business consists of two components:

- operating insurance service result: insurance contract revenues (of which the CSM release is the main driver), insurance contract expenses, reinsurance result and other operating income and expenses

- operating investment result: it mainly includes the net finance result from non-participating business and the net current income from assets backing the shareholders’ funds

New Business Value: represents the expected value created within the Group by the new insurance and investment contracts issued over the reporting period. It is calculated consistently with the IFRS17 framework, as the sum of the following items (net of taxes, minority interests and cost of external reinsurance): (i) New Business Contractual Service Margin (New Business CSM) including potential loss component, (ii) the value of short-term business measured under the Premium Allocation Approach (PAA) and investment contracts falling under IFRS 9, (iii) look-through profits emerging outside the Life segment (mostly related to fees paid to internal asset managers).

P&C operating result: the result of the P&C business consists of two components

- operating Insurance Service Result, insurance contract revenues (on an earned basis), insurance contract expenses (claims and costs attributable to insurance contracts), reinsurance result and other operating income and expenses

- operating investment result: the operating income mainly includes current income from investments and other operating net finance expenses, which include the unwinding of the discounting of the technical provisions.

1 Starting from 1Q 2023 the bancassurance JVs of Cattolica (Vera and BCC companies) are considered a ‘disposal group held for sale’ under IFRS 5 and therefore their results are reclassified in the ‘Result of discontinued operations’. Consequently, the Group results 1Q 2022 presented last year have been restated. The result of discontinued operations amounted to € 27 million (€ 1 million 1Q 2022).

Changes in premiums, Life net inflows and new business were presented on equivalent terms (at constant exchange rates and consolidation scope). Changes in the operating result, general account investments and Life insurance liabilities excluded any assets under disposal or disposed of during the same period of comparison. The amounts were rounded and may not add up to the rounded total in all cases. The percentages presented can be affected by the rounding.

2 Adjusted net result and EPS definitions include adjustments for 1) profit or loss on assets at fair value through profit or loss (FVTPL) on non-participating business and shareholders’ funds, 2) hyperinflation effect under IAS 29, 3) amortisation of intangibles related to M&A, 4) impact of gains and losses from acquisitions and disposals.

3 The Financial Information at 31 March 2023 is not an Interim Financial Report according to the IAS 34 principle.

Starting from 1Q 2023 the reported financial information by geographical area reflects the Group’s managerial structure effective as of 1st September 2022 and consists of: Italy, France, DACH (including Germany, Austria, Switzerland), International region (including Central Eastern Europe, Mediterranean & Latin America and Asia), Asset & Wealth Management and Group holdings and other companies, which includes also Europ Assistance and Global Business Activities.

4 Including premiums from investment contracts equal to € 479 million (€ 261 million 1Q 2022).

5 3 year CAGR based on 2024 Adjusted EPS (according to IFRS17/9 accounting standards and Adjusted Net Result definition currently adopted by the Group), versus FY 2021 Adjusted EPS (according to IFRS4 accounting standards and Adjusted Net Result definition adopted by the Group until FY 2022).

6 Net holding cash flow and dividend expressed in cash view.