GENERALI GROUP CONSOLIDATED RESULTS AS AT 30 JUNE 2020 (1)

30 July 2020

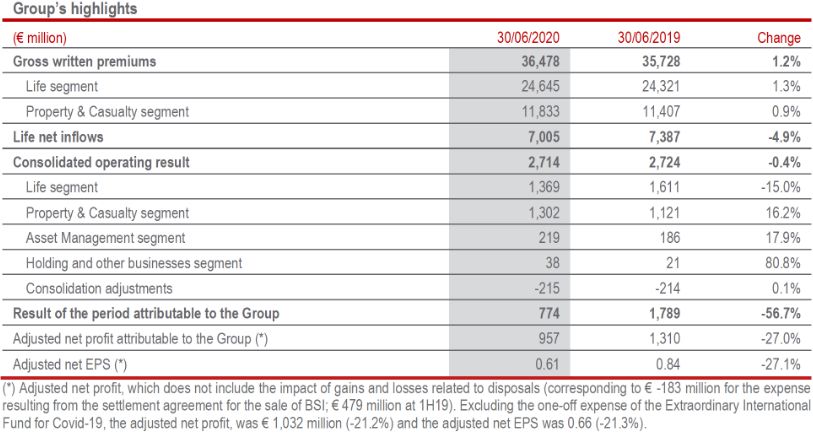

STRONG PROFITABILITY OF THE BUSINESS IN A CHALLENGING ENVIRONMENT WITH A STABLE FIRST-HALF OPERATING RESULT OF € 2.7 BILLION. NET RESULT AFFECTED BY IMPAIRMENTS, THE BSI SETTLEMENT AND THE IMPACT OF THE COVID-19 EMERGENCY FUND. SOLID CAPITAL POSITION CONFIRMED.

- Operating result of € 2.7 billion, with an increase in the P&C and Asset Management businesses, supported also by recent acquisitions, and in the Holding and other businesses, which offset a decrease in the Life segment. Technical excellence was confirmed, with a Combined Ratio of 89.5% (91.8% 1H19) and a strong New Business Margin at 3.94% (4.40% 1H19)

- Total gross written premiums reached € 36.5 billion (+1.2%) thanks to the positive performance of the Life (+1.3%) and P&C (+0.9%) businesses. Life net inflows, focused on unit-linked and protection lines, amounted to € 7 billion (-4.9%) and life technical provisions rose to € 372 billion (+0.7%)

- The Asset Management segment profit stood at € 164 million (+23%)

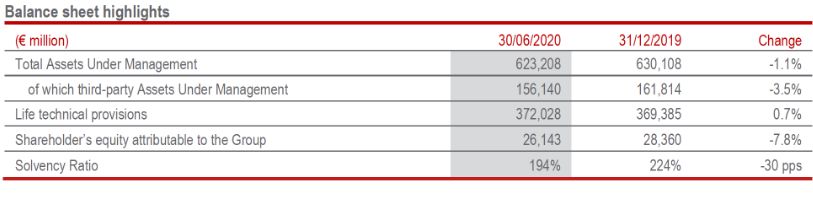

- The Solvency Ratio continued to be solid at 194% (-2 pps vs 1Q20)

- The Group’s net profit stood at € 774 million (-56.7%), reflecting € 226 million of net impairments on investments related to the performance of the financial markets, € 183 million for the arbitration settlement for the sale of BSI and the contribution of € 1002 million to the Extraordinary International Fund for the pandemic emergency. The adjusted net profit3, excluding the one-off expense of the Extraordinary International Fund for Covid-19, stood at € 1,032 million (-21.2%)

Generali Group CEO Philippe Donnet commented: “The performance in the first half of the year confirms the validity of the Group’s strategy, the solidity of its business model and Generali’s technical excellence which enabled us to face these unprecedented circumstances. One of the Group’s key priorities was to support the communities impacted by Covid-19 through the Extraordinary International Fund and other initiatives. We also responded to this challenging moment by accelerating our innovation and digital transformation of the business and operating structure. Further, we continued to execute our Generali 2021 strategy in a disciplined and effective manner while also pursuing sustainable growth.

I would like to give special recognition to our people - employees, agents and partners - who guaranteed business continuity during these difficult times and who have demonstrated their commitment to being Lifetime Partner for our customers, a commitment highlighted in Generali’s first-ever global advertising campaign launched in July.”

Milan. At a meeting chaired by Gabriele Galateri di Genola, the Assicurazioni Generali Board of Directors approved the 2020 Consolidated Half-Year Financial Report of the Generali Group.

EXECUTIVE SUMMARY

In unprecedented circumstances, with significant macroeconomic and financial impacts resulting from the Covid-19 pandemic, the Group’s half-year results demonstrate a resilient operating performance and confirm its solid capital position.

The operating result stood at € 2,714 million (€ 2,724 million 1H19).

For the Life business, the operating result was impacted (-15%) notwithstanding the positive trend of the technical margin net of insurance operating expenses. This was due to the reduction of the net investment result, related to the negative performance of the global financial markets, also due to the effects of the Covid-19. In particular, the Life operating result in Switzerland went from € 98 million in 1H19 to € -156 million in 1H20 as a result of the acceleration of provisions related to guarantees for policyholders in the country. That increase reflects more conservative long-term financial assumptions.

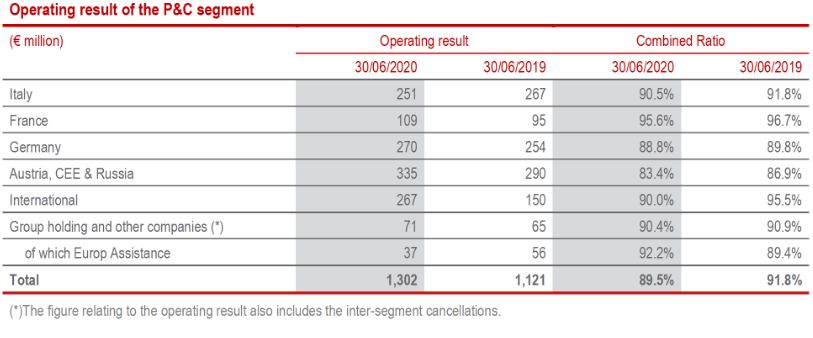

The improvement in the P&C business (+16.2%) is thanks to the increase of technical profitability and to the positive contribution of € 56 million from the new acquisition of Seguradoras Unidas in Portugal. The Combined Ratio improved to 89.5% (91.8% 1H19), driven by the improvement in the non-catastrophe current year loss ratio recorded in the motor business in all major countries in which the Group operates, and also related to the impact of lockdown restrictions which changed customer behaviours.

The operating result of the Asset Management segment was up (+17.9%), mainly due to the increase in operating revenues (+16.8%, up to € 421 million) thanks to the growing contribution of the multi-boutique platform.

The Holding and other businesses segment operating result rose, driven by an improved performance of Banca Generali.

The non-operating result of € -941 million (€ -588 million 1H19), reflects € 250 million of impairments on investments (available for sale financial assets), as result of the financial markets situation also impacted by the global Covid-19 outbreak, as well as € 93 million of impairments related to the goodwill of the Company’s Life business in Switzerland.

The decrease was also due to a non-operating expense of € 100 million for the establishment of the Extraordinary International Fund launched by the Group – in addition € 54 million were also allocated to fund local initiatives - to support relief efforts during the Covid-19 pandemic emergency.

The contribution of interest on financial debt was positive, driven by the debt reduction strategy launched in 2019 and which is continuing in 2020.

Gross written premiums for the Group amounted to € 36,478 million, up 1.2% as a result of the development of both business segments. Excluding the written premiums of a collective Life pension fund in Italy in June 20204, corresponding to approximately € 1.5 billion, the Group’s gross written premiums would have posted a decrease of 3%.

Premiums in the Life segment5 rose by 1.3% to € 24,645 million.

Life net inflows were € 7,005 million (-4.9%) due to lower premiums and higher surrenders in France, as well as higher surrenders in Germany.

Premiums in the P&C segment rose to € 11,833 million (+0.9% on equivalent terms).

The tax rate rose from 31.5% to 38.5% following the greater impact of non-deductible expenses.

The Group’s net result amounted to € 774 million compared to € 1,789 million in the first half of 2019 (-56.7%).

The adjusted net profit amounted to € 957 million (€ 1,310 million 1H19); this does not include the impact of the gains and losses on disposals of € -183 million resulting from the settlement agreement with BTG Pactual, which ended the arbitration for the sale of BSI (€ 479 million 1H19, relating to the sale of Generali Leben and the Belgian businesses).

Excluding the one-off expense of the Extraordinary International Fund for Covid-19, the adjusted net profit was € 1,032 million (-21.2%).

The Group had total Assets Under Management of € 623.2 billion, a decrease of 1.1% compared to 31 December 2019, following the decline in the value of assets, due to the performance of financial markets in the period, as well as the decrease in value of third-party Assets Under Management. The latter reached € 156.1 billion, down 3.5%, reflecting the situation of the financial markets as well as the outflows recorded for some portfolios in the first part of the year.

Life technical provisions amounted to € 372,028 million. The modest increase (+0.7% at constant scope) was impacted by the decrease of the unit-linked component, which reflects the performance of the financial markets.

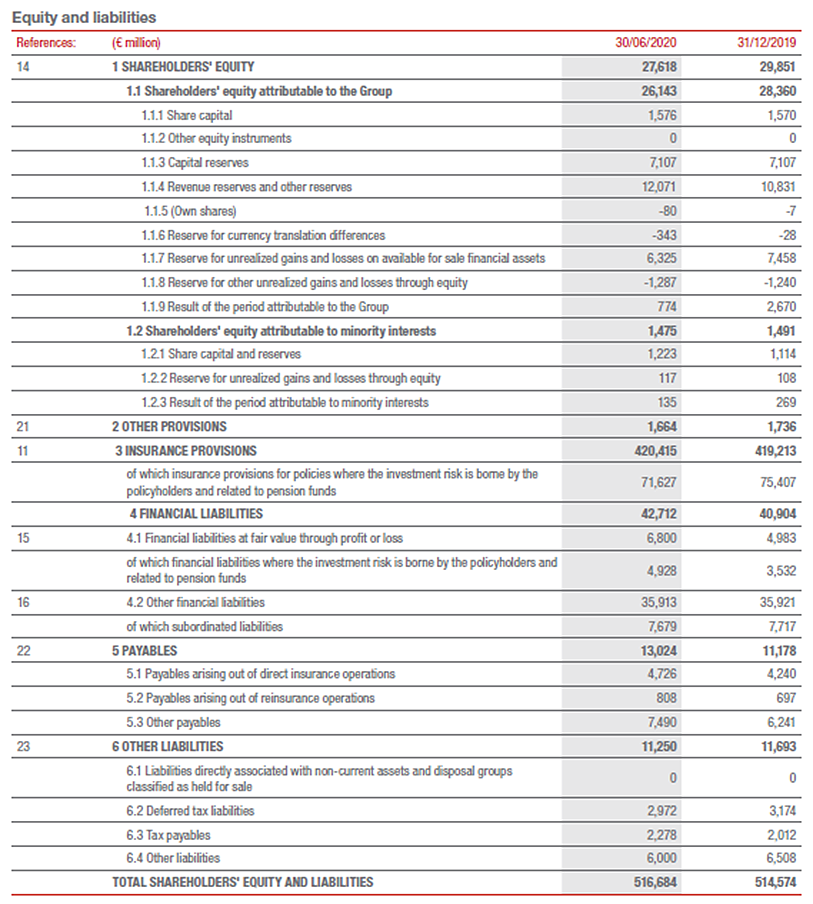

The Group’s shareholders’ equity amounted to € 26,143 million (-7.8%). Considering the result for the period of € 774 million, the reduction is due to the decrease in the reserve for unrealized gains and losses on available for sale financial assets of € 1,133 million - mainly attributable to the performance of bonds - as well as to the dividend for a total of € 1,513 million, the first tranche of which was paid in May.

In the current international economic and financial environment characterized by great uncertainty, at the end of June the Solvency Ratio - which represents the regulatory view of the Group’s capital and is based on the use of the internal model for companies that have obtained the relative approval from IVASS, and on the Standard Formula for the other companies – remained solid standing at 194%, a decline of 2 pps compared with the end of the first quarter 2020. Compared to 224% at year-end, the 30 pps decline was due to the negative impact of market variances (-26 pps) relating to the Covid-19 pandemic and to the regulatory changes (-4 pps) implemented at the beginning of the year (EIOPA change on the Ultimate Forward Rate and the treatment of the IORP business in France).

The very positive normalized capital generation, net of the accrued dividend calculated on a pro rata basis compared to the full dividend of 2019, contributed more than 6 pps thanks to the positive effect from the Life and P&C segments. That effect was largely offset by the acquisition of Seguradoras Unidas and AdvanceCare in Portugal and by extraordinary variances in the period (the agreement to settle the arbitration for the sale of BSI and the establishment of the Extraordinary International Fund for the Covid-19 emergency).

LIFE SEGMENT

- Gross written premiums rose to € 24.6 billion (+1.3%) and net inflows, focused on unit-linked and protection lines, amounted to € 7 billion (-4.9%)

- Solid new business margin at 3.94% (-0.46 pps) and new business value (NBV) at € 887 million (-5.5%)

Gross written premiums in the Life segment grew to € 24,645 million, up by 1.3% compared to the first half of 2019.

This performance was underpinned by the positive trend of unit-linked products (+35.8%), which benefitted from the above-mentioned collective pension fund. Savings products fell (-11.1%) in all countries in which the Group operates, with the exception of Germany. Protection products were down slightly (-0.7%), posting varying performances.

With regard to the main countries in which the Group operates, Italy (+14%) benefitted from the performance of protection products and, to a greater extent, from unit-linked products, thanks to the above-mentioned pension fund.

Germany’s performance was positive (+2.8%), where both the premiums of unit-linked products and of savings products rose, as was ACEER (+0.3%). The downturn witnessed in France (-19%) was entirely caused by the significant decline of savings product premiums due to, on the one hand, measures taken to change the business mix and, on the other, the comparison to a particularly positive first-half 2019.

Life net inflows totalled € 7,005 million (-4.9%) following the performance in France, due to lower premiums and higher surrenders, the latter also witnessed in Germany.

New business in terms of PVNBP (present value of new business premiums) amounted to € 22,521 million (+5.6%). The rise in unit-linked products in Italy, which benefitted from the above- mentioned collective pension fund, more than offset the reduction in volumes caused by the current Covid-19 pandemic. In terms of business lines, the unit-linked segment posted a noteworthy increase (+46.1%) thanks to a rise in new business in all areas, in particular due to the contribution of the above-mentioned pension fund in Italy. Protection products were up (+4.6%), thanks to the performance in Germany (+15%), which fully offset the slight decline in other countries. Savings products in the main areas in which the Group operates were down (- 13.8%), primarily in France (-48.9%) due to the shift towards more profitable unit-linked products, and in Italy (-11.9%), while the performance was partly offset by the good results posted in Germany (+33.3%).

The new business margin was 3.94% (4.40% 1H19), with a decrease of 0.46 pps at constant scope, due mainly to the unfavourable financial environment, only partly offset by a further recalibration of financial guarantees and a more favourable business mix.

Consequently, new business value (NBV) was € 887 million (€ 942 million 1H19), down 5.5% at constant scope compared to the first six months of 2019.

The operating result stood at € 1,369 million (€ 1,611 million 1H19), reflecting the slowdown of the net investment result due to the negative impact of the markets, and, in particular, to the resulting acceleration of provisions for guarantees for policyholders in Switzerland, also due to the effects of Covid-19. The technical margin net of insurance operating expenses improved mainly thanks to the performance witnessed in Germany.

P&C SEGMENT

- Premiums increased to € 11.8 billion thanks to the non-motor business line (+1.7%)

- The Combined Ratio was 89.5% (-2.3 pps), due to a lower current loss ratio

- Significant rise in operating result growth to € 1.3 billion (+16.2%)

Premiums in the P&C segment rose to € 11,833 million (+0.9% on equivalent terms) due to growth of the non-motor line (+1.7%) witnessed in all countries in which the Group operates.

More specifically, non-motor premiums in Italy rose (+6.2%), benefitting from rising demand in the accident and health segment, the positive performance of corporate lines and from assistance policies linked to Covid-19 for the business segment. Performance in ACEER was positive (+2.4%, driven by Poland, Austria and Hungary). Europ Assistance was down (-27.1%), with premiums impacted by the pandemic, especially in travel insurance.

The motor business line fell by 0.5%, posting varying performances across the Group. The performance in ACEER was positive (+2.6%), and reflects, in particular, the growth witnessed in the Czech Republic and Poland, mainly driven by other motor damage insurance, and in Hungary, sustained by growth of the average premium. The performance in France (+1.8%) was also positive, thanks to the contribution of new partnerships and of the fleets segment, and the Americas and Southern Europe (+10.5%) following rate adjustments for inflation. Meanwhile, premiums in Italy fell (-7%), particularly in the third party liability segment, which posted a decline in average premiums and in the portfolio, also due to the lower volume of new business during the lockdown, and in Germany (-1.2% largely due to less new production as a result of the pandemic).

The operating result stood at € 1,302 million (€ 1,121 million 1H19). The 16.2% rise was mainly due to the increase of the technical result, which reflects the improvement of the CoR.

The 6.9% decrease in the financial result was due to lower current income based on the present situation of market interest rates and lower share dividends.

The deterioration of the other operating components is due to costs related to the reorganisation of the German businesses.

The Combined Ratio was 89.5% (-2.3 pps). The improvement is the result of the fall of the non- catastrophe current year loss ratio posted in the motor business in all major countries in which the Group operates; it is also due to the effects of lockdown restrictions. The contribution from previous years fell by -2.5 pps (-4.1 pps 1H19). In the half year, natural catastrophe claims reached € 118 million (€ 142 million 1H19) corresponding to 1.1 pps of the CoR, resulting mainly from the storm that impacted Spain and France in the second half of January and from the storm that affected Central Europe at the beginning of February. The expense ratio also improved (27.9%; -0.7 pps) reflecting the decline in the acquisition component, mainly linked to the motor business line.

ASSET MANAGEMENT SEGMENT

The operating result of the Asset Management segment reached € 219 million, up by 17.9% compared to the first half of 2019. This performance was largely due to the increase in operating revenues to € 421 million (+16.8%) thanks to the positive contribution of the multi-boutiques platform and to disciplined cost management, with a cost/income ratio almost stable at 48%, with an operating margin at 52%, well above the strategic target of 45%.

The contribution of external clients reached 32% of the total revenues, in line with the goal of 35%.

The net profit of the Asset Management segment stood at approximately € 164 million (+23.0%).

The total of Assets Under Management from the segment was € 527 billion at 30 June 2020.

Third-party Assets Under Management went from € 102 billion at 30 June 2019 to € 97 billion in the first half of 2020, as a result of the negative outflows in the period and the decrease in the value of assets caused by the high volatility of financial markets due to the Covid-19 impact.

HOLDING AND OTHER BUSINESSES SEGMENT

The operating result of the Holding and other businesses segment was € 38 million (€ 21 million 1H19) thanks to Banca Generali’s increased results driven by higher performance fees.

The net operating holding expenses were € -256 million (€ -251 million 1H19), due to the increased costs of the operating entities linked to the Group’s strategic projects.

COVID-19 DISCLOSURE6

The Covid-19 pandemic had impacts on the Group’s various business segments.

In the Life segment, unit-linked products posted a slowdown in new business growth, following volatility in the equity markets. The savings business posted a decrease in new business and a rise in surrenders. Protection policies were only partially affected thanks to the rise in the demand for insurance coverage by customers.

With regard to technical profitability, to date, the impact has been insignificant.

With regard to the P&C segment, new production and renewals were particularly impacted from March until June; a decline in premiums in the motor line, businesses and SMEs was posted, due to the effects of the lockdown. Motor claims posted a decline in March while the non-motor business showed higher costs for some lines (due, for example to the reimbursement of cancelled trips). The Group is not exposed to the business of event cancellations, one of the worst hit sectors in the crisis. The Asset and Wealth Management segment experienced a double impact from the pandemic: asset-based commissions fell following the decline in share prices and in fixed- income securities (including BTP and other peripheral government securities), and in addition there were outflows from some investors.

Generali responded to the changed operating environment by increasing its range of products with new coverage and services, adapting terms and conditions in an effort to manage the lockdown environment. Further, the Group accelerated the process of digitalisation to provide on- line sales and customer assistance. The Group provided financial support, going beyond what was required by the authorities and governments, both to its customers and to its network of agents. Generali undertook measures to protect its customers in all countries - in particular, in the motor line - and will continue to implement them in the second half of the year. In the Asset Management segment, Generali promptly reacted to protect its customers and policyholders, by continuously monitoring the quality of its loan portfolio, revaluating the ability to assume risk in its insurance portfolios and prudently managing liquidity to handle a potential increase in surrenders.

Considering these circumstances, it is estimated that the Group’s operating result was negatively impacted for approximately € -84 million as result of the Covid-19 pandemic. In particular, it is estimated that the Life business was negatively impacted for a total of € -225 million, largely due to the lower investment net result, given the above-mentioned financial markets environment.

It is estimated that the P&C business was positively impacted for € 87 million: the higher number of claims directly linked to the pandemic and lower current income were more than offset by the fewer claims registered in the first six months of the year as result of the lockdown in the main countries where the Group operates.

Finally, it is estimated that the operating result was positively impacted by a reduction of costs following the various initiatives put in place by the Group in response to the Covid-19 crisis. Some of these initiatives include the new way of working, in order to ensure the safety of the Group’s employees, through the extension of smart working that led to cost savings (e.g. travel expenses, event expenses, etc.).

The Group’s non-operating result was impacted, furthermore, by the establishment of the Extraordinary International Fund for € 100 million as well as other local initiatives for an additional € 54 million implemented to respond to the Covid-19 emergency.

The Group’s net result was impacted for € 226 million of net impairments on investments caused by the financial markets performance.

OUTLOOK

In a scenario where the gradual elimination of restrictive measures by the various countries hit by the pandemic is expected, global GDP is predicted to reach record lows in the second quarter of the year, with a decrease of over 5%, while unemployment is expected to rise. These forecasts, together with economic and health-related uncertainty, have triggered a greater propensity for savings, with a negative impact on consumption. The significant boost of monetary and tax policies will likely help mitigate, but not fully offset, these dynamics.

While a gradual recovery is predicted from the second half of 2020, the scenario continues to be highly uncertain. The greatest unknowns concern the evolution of the virus and the ability of researchers and governments to provide effective remedies or vaccines on a global scale. A second wave of infections in the Autumn, could, for example, be particularly harmful. The consequences of the virus in the health, social, political and economic spheres will continue to be subject to great uncertainties. The European political leaders followed the ECB’s initiatives in a coherent manner, integrating the bold monetary stimulus from the Central Bank with the creation of the Recovery Fund. The fund was designed to protect the stability of the Eurozone and to sustain its growth, especially in its peripheral countries, thus contributing to a less diversified economic development plan within the area itself.

Such a context of uncertainty creates noteworthy difficulties in evaluating the overall effect on the global insurance industry. As such, the Generali Group, thanks to its business mix and diversification, foresees that its operating result continues to be resilient in 2020, even though probably lower than in 2019.

From an operational standpoint, the macroeconomic consequences of Covid-19 will have a negative impact on the evolution of the Group’s premiums, especially in travel insurance.

With regard to overall claims, following the decrease witnessed in the months of lockdown, uncertainty for the rest of the year still remains. In case of a second wave, the Group is able to count on a favourable business mix and on solid policy terms.

With the view to mitigate the impact of the forecast reduction of revenues (volumes and financial income), Generali will continue its commitment to reduce its cost base.

Coherent with its ambition to be Lifetime Partner and its commitment to sustainability, the Group has implemented a series of measures to support its employees, its customers, its agents and the communities where it is present. Even if these initiatives have an impact on our cost base and on our results in the short term, our commitment will continue because the well-being and the safety of our stakeholders are an investment for our future.

Taking into account the negative impact from the financial markets and from some non-recurring expenses in the first half of the year, the net result 2020 is expected to be lower than that of 2019. Even with these uncertainties, the current environment has confirmed the validity of the Generali 2021 strategy and the foundation on which it was built, the solidity of the Group’s business model and its technical excellence.

The rigorous execution of the strategy has allowed Generali to face the first-half of 2020 with solid fundamentals, both from an operational standpoint and in terms of its capital position and liquidity. The Group’s liquidity, even after the payment of the first tranche of the dividend, is at the highest level ever.

Generali will therefore continue to implement its strategy: the strong brand, underpinned by the Group’s first global advertising campaign, the disciplined approach in underwriting and the digital transformation are and will be its main distinctive characteristics. The Group’s mission to be Lifetime Partner for its customers offering them personalized solutions is even stronger under the current circumstances.

In this unprecedented moment, the entire Group remains focused on implementing the Generali 2021 strategy.

With regard to the significant events after 30 June 2020:

The repurchase of around € 600 million of three series of subordinated notes with first call date in 2022 and the placement of the Group’s second green bond. For the new issue, orders corresponding to € 4.5 billion were received, over seven times the offer, from a highly diversified base of over 350 international institutional investors, including a significant presence of funds with green/SRI mandates. The Group continues in its efforts to reduce interest expense on financial debt, in line with the same transaction carried out in September 2019. This liability management transaction will result in a one-off expense of € 94 million in the third quarter of 20207.

Launch of the first global advertising campaign, in three stages: the first focused on agents; the second dedicated to the brand, and the third focused on key products and hallmarks in 2021.

Signed a Memorandum of Understanding between Generali and Eurochambres, the European organization of Chambers of Commerce and Industry, under which they agreed to cooperate so as to promote and implement a potential ‘Pandemic Risk Pool’ against future pandemic risks.

Significant events that occurred in the period, as well as the glossary, which also includes a description of the alternative performance indicators, are available in the Consolidated Half- Year Financial Report 2020 of the Generali Group.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

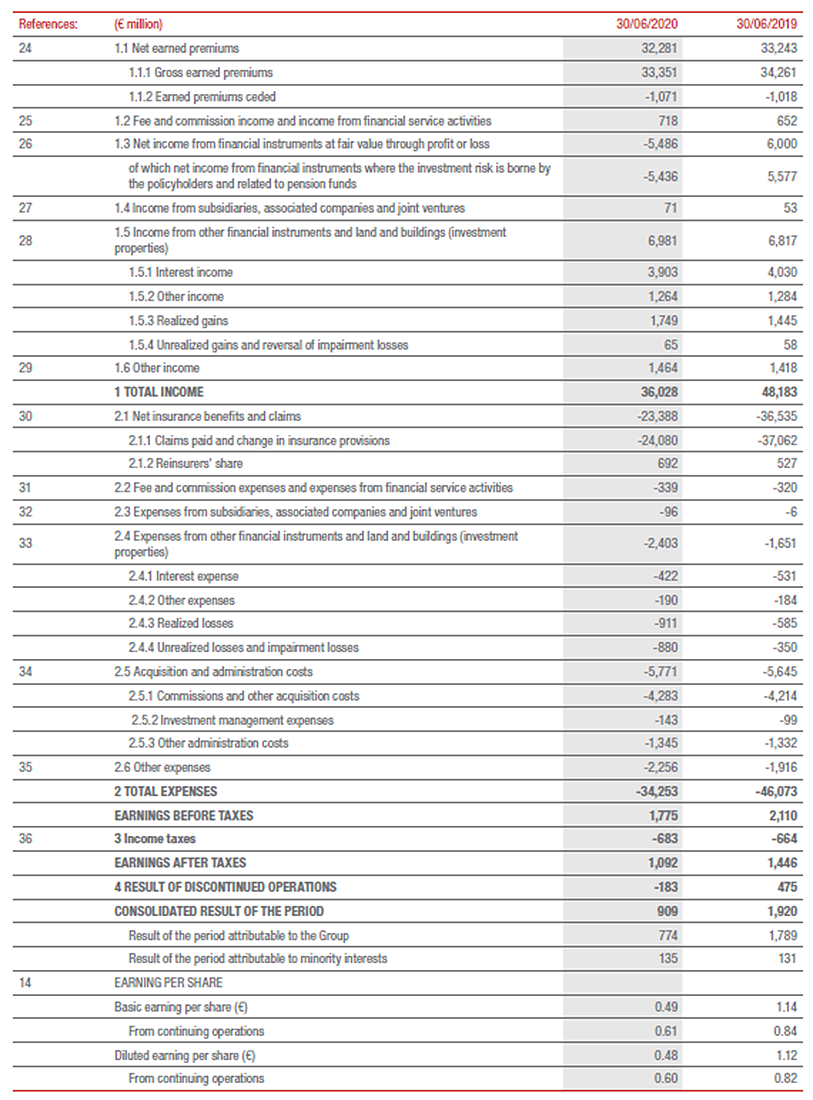

GROUP BALANCE SHEET AND INCOME STATEMENT8

BALANCE SHEET

INCOME STATEMENT

1Changes in premiums, Life net inflows and PVNBP (present value of new business premiums) are presented in equivalent terms (at constant exchange rates and consolidation scope). Changes in the operating result, own investments and Life technical provisions exclude assets disposed of during the same period of comparison.

2This amount, net of taxes, is € 75 million.

3The adjusted net profit does not include the impact of the gains and losses on disposals, amounting to € -183 million at 1H20, resulting from the settlement agreement for the sale of BSI (€ 479 million 1H19, relating to the sale of Generali Leben and the Belgian businesses).

4Generali won the mandate for the management of two investment segments of Cometa, the National Supplementary Pension Fund for workers in the engineering industry, the installation of industrial plants and similar sectors and for employees in the goldsmith and silversmith sector.

5Including € 2,333 million of premiums from investment contracts, of which around € 1.5 billion of premiums from the above-mentioned collective Life pension fund in Italy.

6The current uncertain environment makes it very difficult to evaluate the overall effect of the pandemic, both in the present and in the future. For more information, please see the Outlook section. Further, the impacts of the Covid-19 pandemic on the Group’s results, with reference to all the segments in which the Group operates, were estimated taking into account the direct effects coming from Covid-19. These direct effects, for example, include higher claims linked to the pandemic itself and the establishment of Funds to support communities affected by Covid-19. There were indirect effects taken into account as well, for which it was necessary to estimate the degree to whitch their impact was due to Covid-19. In this category, the effects include lower volumes, fewer claims posted in the first six months of the year as result of the lockdown, as well as the lower operating investment result that was affected by the financial markets performance.

7This amount, net of taxes, will be € 73 million.

8With regard to the financial statements envisaged by law, note that statutory audit has not been completed on the data. The Group will publish the final version of the Consolidated Half-Year Financial Report 2020 on the corporate website in accordance with the prevailing law, also including the Independent Auditor’s Report.