Generali Group consolidated Results at 31 december 2023

12 March 2024

Generali achieves record results with accelerated growth in dividend per share

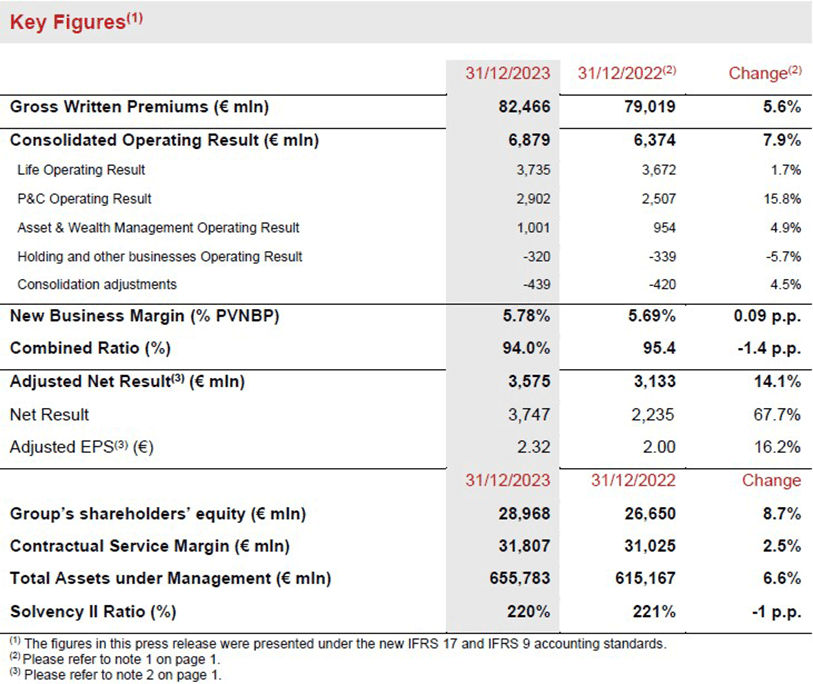

- Gross written premiums increased to € 82.5 billion (+5.6%), driven by significant P&C growth (+12.0%). Life net inflows entirely focused on unit-linked and protection, consistent with the Group’s strategy

- Record operating result at € 6.9 billion (+7.9%), thanks to positive contribution from all segments, led by P&C. The Combined Ratio improved to 94.0% (-1.4 p.p.). Excellent New Business Margin at 5.78% (+0.09 p.p.)

- Record adjusted net result2 at € 3,575 million (+14.1%)

- Solid capital position, with the Solvency Ratio at 220% (221% FY2022), thanks to the strong contribution from normalised capital generation

- Proposed dividend per share of € 1.28 (+10.3%) confirms the Group’s strong focus on shareholders remuneration and achieves3 the 2022-2024 cumulative dividend target

Generali Group CEO, Philippe Donnet, said: “Generali’s strong performance in 2023, underpinned by a record in operating and net result with the positive contribution of all segments, demonstrates the successful execution of our ‘Lifetime Partner 24: Driving Growth’ strategy. Thanks to our strong cash and capital position we are accelerating the growth of dividends for our shareholders. The Group is in the best shape it has ever been as a profitable, diversified Insurance and Asset Management player. Generali’s future success will also benefit from the acquisitions of Conning and Liberty Seguros. I would like to take this opportunity to thank all our colleagues and agents for their efforts to achieve these very positive results. They are the foundation of our sustainable growth journey and of our commitment to act as a responsible investor, insurer, employer and corporate citizen.”

Executive summary

Milan - At a meeting chaired by Andrea Sironi, the Assicurazioni Generali Board of Directors approved the consolidated financial statements and the Parent Company’s draft financial statements for the year 2023.

Gross written premiums rose to € 82,466 million (+5.6%), thanks to significant P&C segment growth.

Life net inflows were € -1,313 million. The fourth quarter showed an overall trend improvement for Life net inflows compared to previous quarters, with lower net outflows from Savings and with positive net inflows in both unit-linked and protection. This is in line with the Group's strategy to reposition the Life portfolio and it also reflects the industry trends observed in the banking channels in Italy and in France.

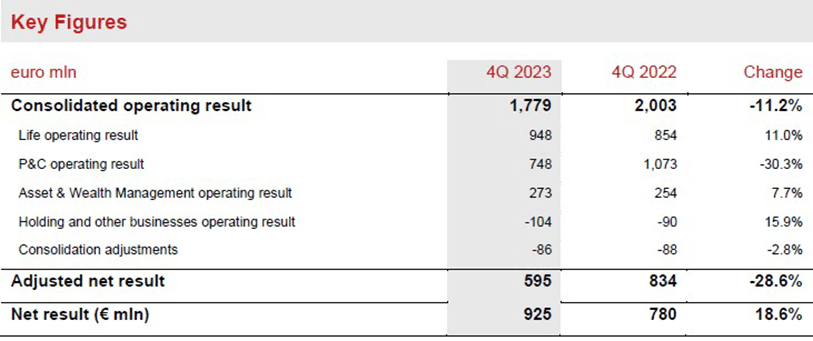

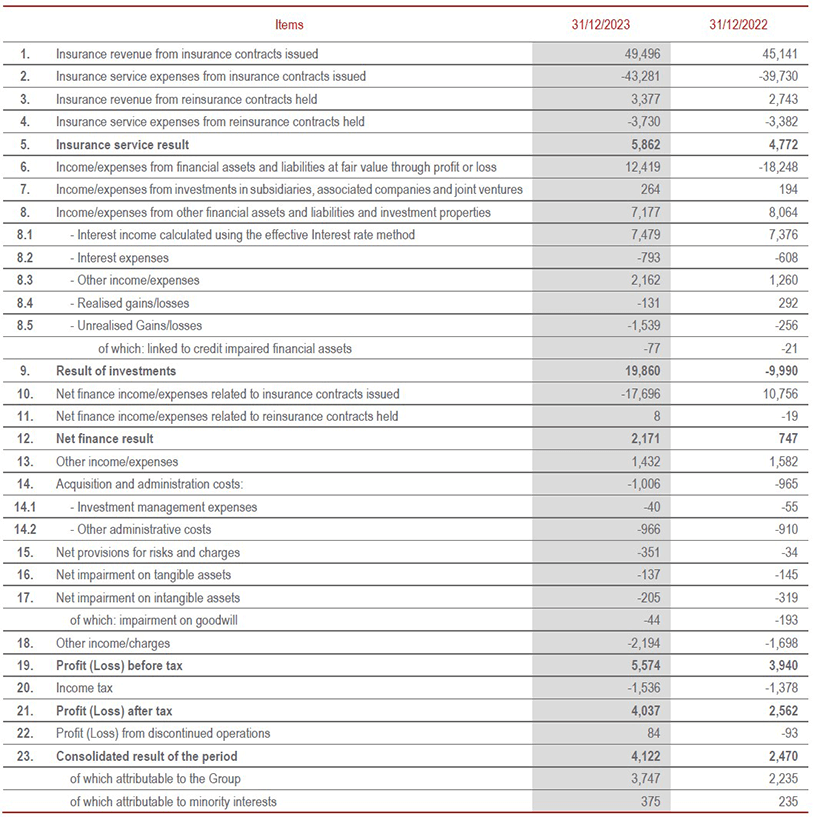

The operating result increased strongly to reach a record € 6,879 million (+7.9%), with growth across all lines of business, reflecting the resilience and the diversification of profit sources.

In particular, the P&C segment operating result grew to € 2,902 million (+15.8%). The Combined Ratio improved to 94.0% (-1.4 p.p.), driven by a lower loss ratio, primarily thanks to higher discounting effect and a lower undiscounted attritional4 combined ratio, offsetting the significant impact from natural catastrophes.

The Life operating result was solid at € 3,735 million (+1.7%) and the New Business Margin increased to 5.78% (+0.09 p.p.).

The operating result of the Asset & Wealth Management segment grew to € 1,001 million (+4.9%), driven by a strong contribution from Banca Generali.

The operating result of the Holding and other businesses segment improved to € -320 million (€ -339 million FY2022).

The adjusted net result5 achieves the record level of € 3,575 million (€ 3,133 million FY2022). This was primarily thanks to the improved operating result, which benefited from diversified profit sources, a non-recurring capital gain related to the disposal of a London real estate development (€ 193 million net of taxes) and a one-off restructuring charge in Italy (around €-165 million net of taxes), while also reflecting the impact from € -71 million in impairments on Russian fixed income instruments recorded at FY2022.

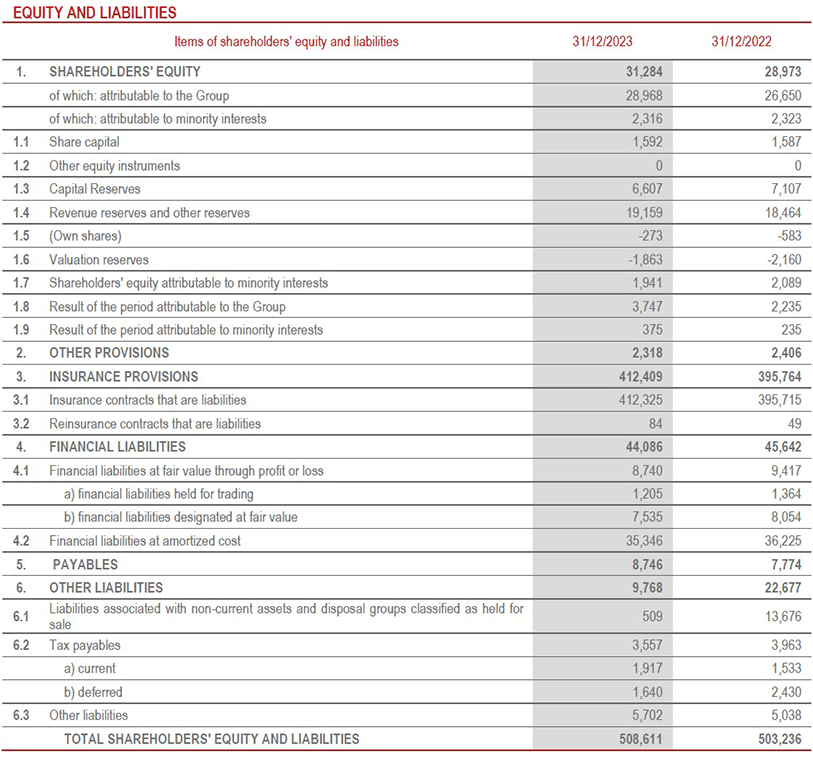

The net result improved to € 3,747 million (€ 2,235 million FY2022) also benefitting from a € 255 million capital gain from the disposal of Generali Deutschland Pensionskasse.

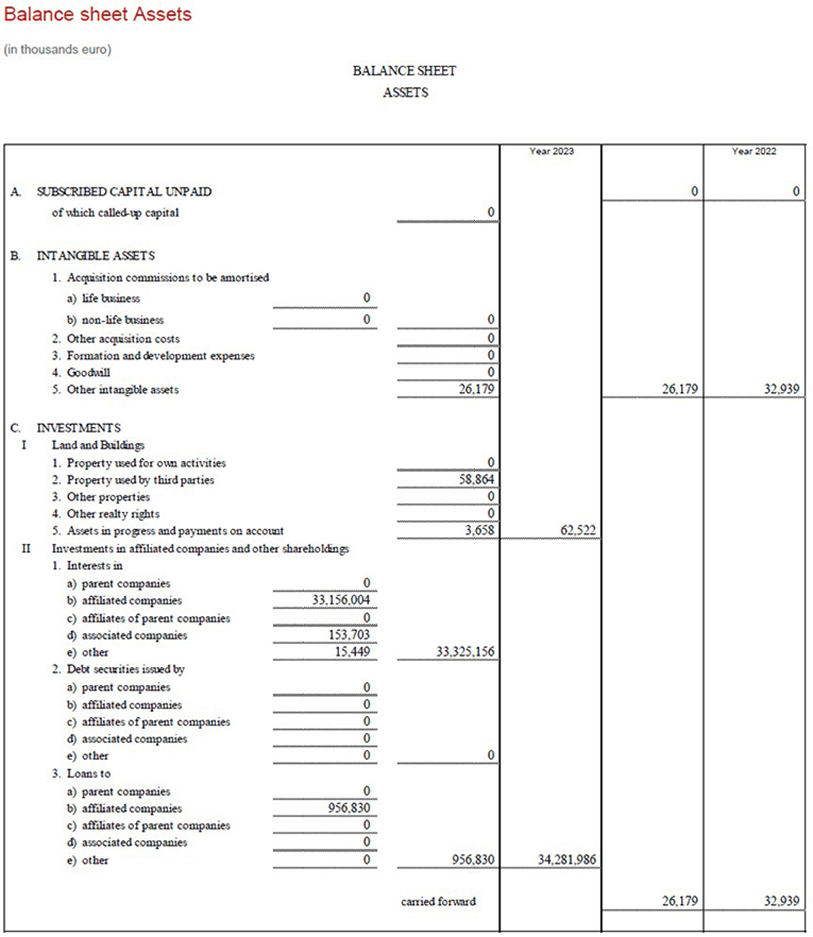

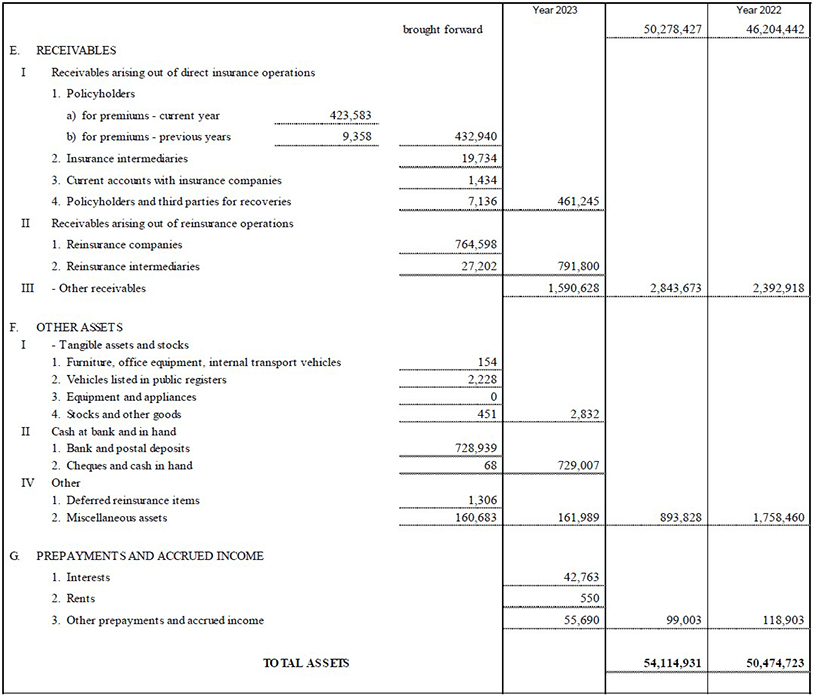

The Group’s shareholders' equity increased to € 29.0 billion (+8.7%), thanks to the net result for the period, partially offset by the dividend payment.

The Contractual Service Margin (CSM) rose to € 31.8 billion (€ 31.0 billion FY2022).

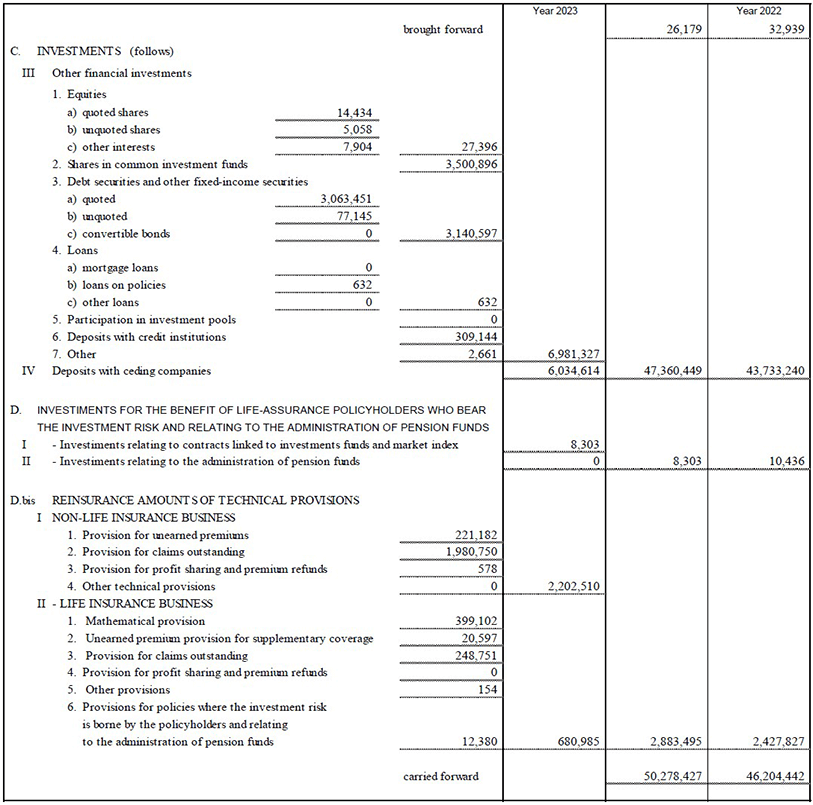

The Group’s Total Assets Under Management grew to € 655.8 billion (+6.6% compared to FY2022) primarily reflecting the positive market effect.

The Group confirmed its solid capital position, with the Solvency Ratio at 220% (221% FY2022).

Dividend per share

The dividend per share which will be proposed at the next Annual General Meeting is € 1.28 payable as from 22 May 2024, while shares will trade ex-dividend as from 20 May 2024.

The dividend per share shows a 10.3% increase compared to the one distributed in 2023, reflecting the Group’s excellent results, the strong cash and capital position and the continuous focus on shareholder returns.

The dividend proposal represents a total maximum pay-out of € 1,987 million.

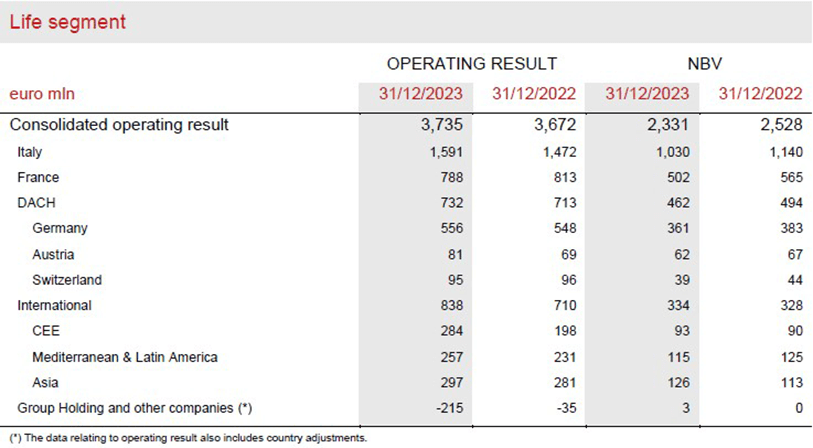

Life Segment

- Operating result reached € 3,735 million (+1.7%)

- Excellent New Business Margin at 5.78% (+0.09 p.p.)

- New Business Value (NBV) was € 2,331 million (-7.7%)

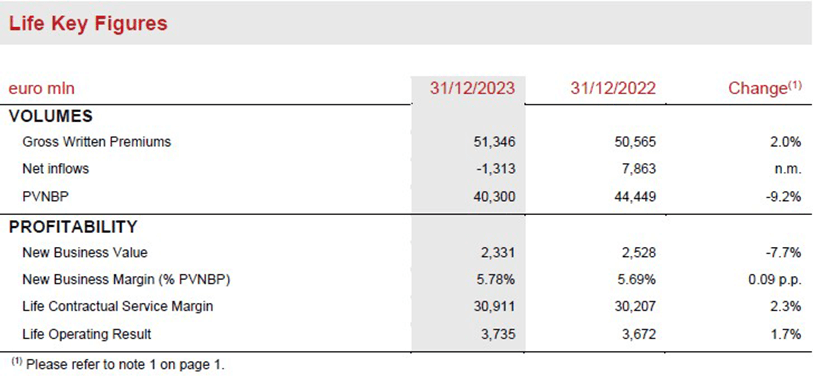

Gross written premiums in the Life Segment6 rose to € 51,346 million (+2.0%). The protection line confirmed its healthy growth trajectory (+6.4%), driven by France and Italy. The savings line also improved significantly (+10.0%), mainly driven by Italy and Asia. The unit-linked line was down (-13.1%), in particular in Italy and France.

Life Net inflows were € -1,313 million. The protection and unit-linked lines recorded positive net inflows, with protection inflows growing to € 4,552 million, led by Italy, France and CEE, while net inflows in the unit-linked line reached € 4,357 million, demonstrating their resilience. Net outflows from savings (€ -10,222 million) were in line with the Group's strategy to reposition its Life business portfolio, also reflecting the industry trends observed across banking channels in Italy and in France. Thanks to these dynamics – combined with the positive market effect on unit-linked reserves and growth of savings reserves with death-only guarantee - the share of reserves with financial guarantees on total Life reserves has fallen by 4 p.p. during 2023 to 61.7% during 2023.

New business volumes (expressed in terms of present value of new business premiums - PVNBP) were € 40,300 million (-9.2%), reflecting the unfavorable economic environment amplified by higher interest rates. The volumes, when expressed in annual premium equivalent terms, which exclude the discounting impact, saw a reduction of 2.7%.

New Business Margin on PVNBP reached an excellent 5.78% (+0.09 p.p.) mainly thanks to the increase of interest rates. The combination of the afore mentioned trends resulted in a New Business Value (NBV) of € 2,331 million (-7.7%).

The Life Contractual Service Margin (Life CSM) increased to € 30,911 million (€ 30,207 million FY2022). The positive development was mainly driven by the contribution of the Life New Business CSM of € 2,796 million, which, coupled with the expected return of € 1,692 million, more than offset the Life CSM release of € 3,035 million. The latter also represented the main driver (over 80%) of the operating result, which rose to € 3,735 million (€ 3,672 million FY2022), despite the impact of non-recurring provisions.

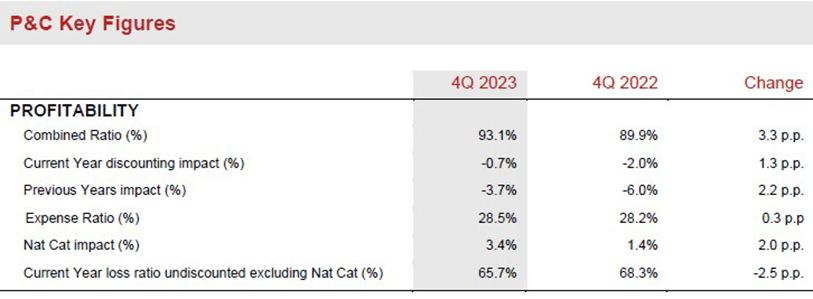

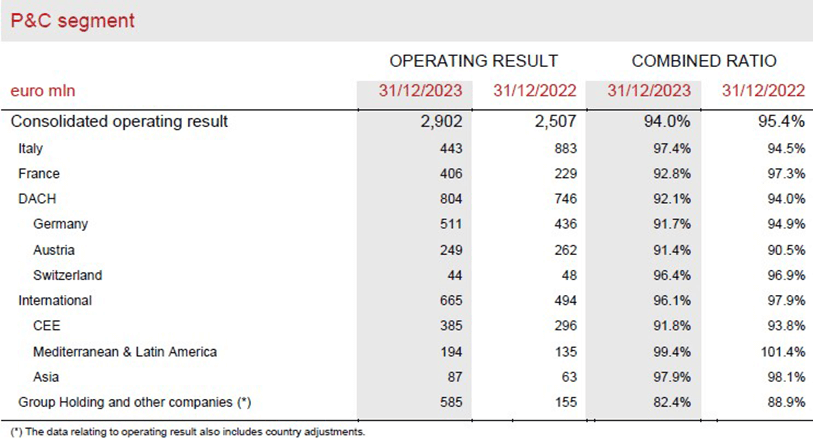

P&C Segment

- Premiums increased to € 31,120 million (+12.0%)

- Combined Ratio improved to 94.0% (-1.4 p.p.)

- Strong growth in operating result to € 2,902 million (+15.8%)

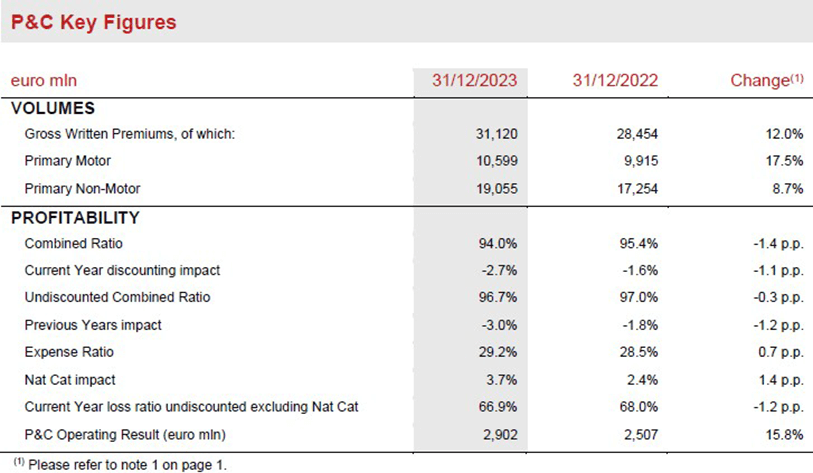

P&C gross written premiums grew to € 31,120 million (+12.0%) thanks to the positive performance of both business lines. Non-motor improved by 8.7%, achieving widespread growth across all main areas in which the Group operates. Europ Assistance premiums grew by 23.5%, thanks to the continued volume expansion in the travel business. The motor line rose by 17.5%, across all the main geographies and especially in Italy, France, CEE and Argentina. Excluding the contribution from Argentina, a country impacted by hyperinflation, motor line premiums increased by 6.3%.

The Combined Ratio was 94.0%, an improvement of 1.4 p.p. from FY2022, thanks to the positive development in the loss ratio to 64.9% (-2.1 p.p.), partly compensated by a slightly higher expense ratio at 29.2% (+0.7 p.p.). The increase in the expense ratio was driven by higher acquisition costs. The positive dynamics in the loss ratio benefitted from a higher discounting effect and an improvement in the undiscounted attritional loss ratio. Natural catastrophes impacted the undiscounted Combined Ratio by 3.7 p.p., (2.4 p.p. in FY2022) and amounted to € 1,127 million (€ 663 million FY2022) on an undiscounted basis. The impact from large man-made claims increased to 1.7 p.p. (1.2 p.p. FY2022). The contribution from prior year development stood at -3.0 p.p. (-1.8 p.p. FY2022). The undiscounted combined ratio improved to 96.7% (97.0% FY2022). Looking in particular at the dynamics in 4Q2023, the current year undiscounted loss ratio excluding natural catastrophes improved by 1.8 p.p. compared to 3Q2023 and by 2.5 p.p. compared to 4Q2022. This improvement confirms the positive impact of the tariff strengthening and other technical measures implemented over the course of the past 18 months across the P&C book to offset claims inflation.

The operating result grew substantially to € 2,902 million (+15.8%). The operating insurance service result was € 1,807 million (€ 1,297 million FY2022), benefitting from a current year discounting effect of € 814 million (€ 463 million FY2022), leading to an undiscounted insurance service result of € 993 million (€ 834 million FY2022). The investment result was € 1,095 million (€ 1,210 million FY2022) with operating investment income at € 1,389 million (€ 1,248 million FY2022) and insurance finance expenses at € -294 million (€ -39 million FY2022).

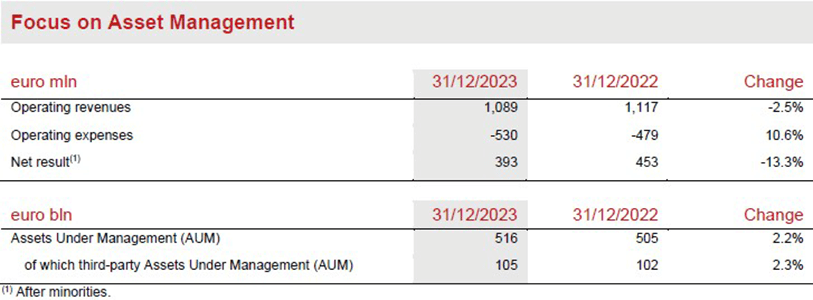

Asset & Wealth Management Segment

- Asset & Wealth Management operating result grew to € 1,001 million (+4.9%)

- Banca Generali group operating result rose to € 441 million (+39.6%), thanks to business diversification and improvement in margins

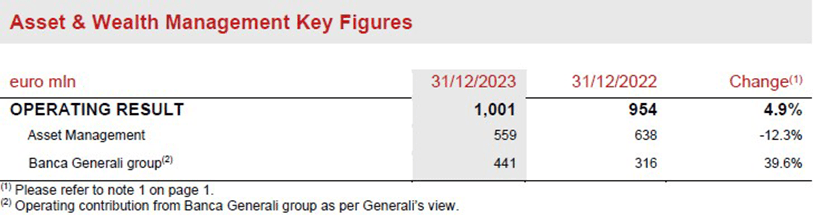

The operating result of the Asset & Wealth Management segment stood at € 1,001 million (+4.9%).

In particular, the Asset Management result stood at € 559 million (-12.3%), mainly reflecting market effect on average Assets Under Management and lower performance fees.

The operating result of the Banca Generali group rose to € 441 million (+39.6%), thanks to the positive contribution of the net interest margin and the continuous diversification of fee income sources.

Total net inflows at Banca Generali in 2023 were € 5.9 billion, up 3% compared to the previous year.

The net result of the Asset Management segment was € 393 million (-13.3%).

The total value of the AUM managed by the Asset Management companies were € 516 billion (+2.2% compared to FY2022). Third-party AUM managed by the Asset Management companies grew to € 105 billion (+2.3% compared to FY2022) with € -1.1 billion net outflows from external clients, mostly related to the non-renewal of a single institutional mandate.

Holding and other business Segment

- Operating result improved to € -320 million

- Positive contribution from France and Planvital

The operating result of the Holding and Other Businesses segment rose to € -320 million (€ -339 million FY2022).

The contribution from other businesses was positive, mainly driven by the improvement recorded in France, primarily thanks to higher intragroup dividends, and Planvital. Holding operating expenses increased by 4.4%, mainly due to costs related to personnel and projects for the implementation of new strategic initiatives7.

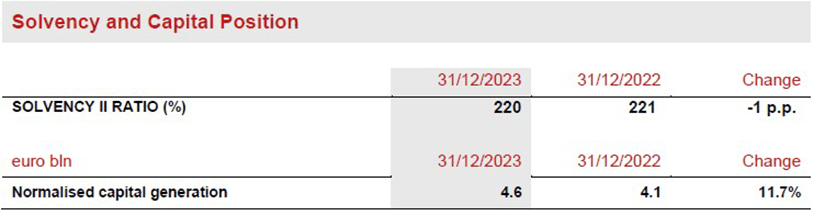

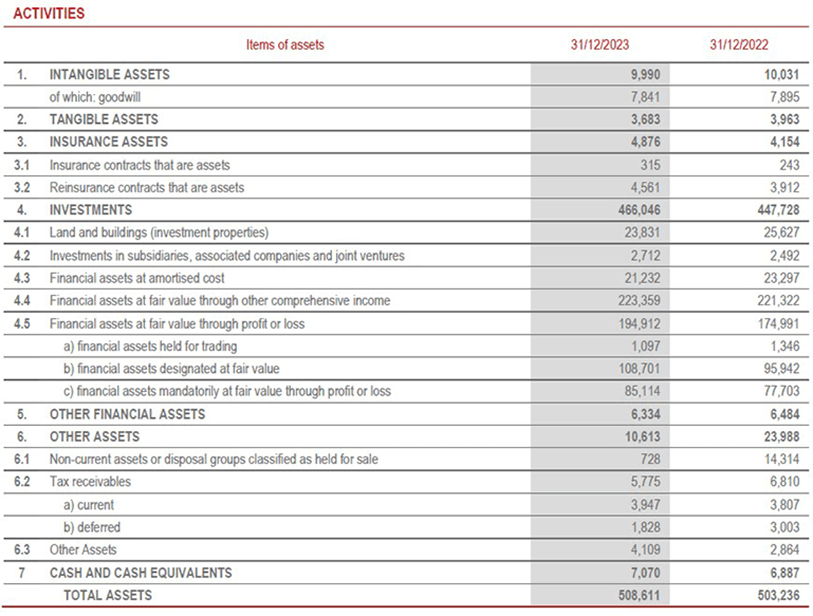

Balance Sheet, Cash and Capital Position

- Solid capital position with the Solvency Ratio at 220% (221% FY2022)

- Strong normalised capital generation at € 4.6 billion

The Group confirmed its solid capital position, with the Solvency Ratio at 220% (221% FY2022). The excellent contribution of the capital generation (+22%) and the positive effect of M&A disposals (+4%) were offset by the negative impacts stemming from economic variances (-6%, due in particular to the decline in interest rates in the last part of the year), non-economic variances (-12%, mainly linked to higher lapses in Italy and in France and to increased P&C insurance and reinsurance risks, as well as to the business growth in Asia and the Long Term Incentive Plan buy-back), regulatory changes (-3%) and capital movements (-6%, from the dividend of the period, net of the subordinated debt issuances).

The normalized capital generation increased to € 4.6 billion (€ 4.1 billion FY2022), supported by the positive contribution of both the Life and P&C segments, also benefitting from the higher unwinding effect.

Outlook

The expected timing and extent of interest rate cuts by central banks are set to drive financial markets in 2024. Inflationary pressures continue to ease and markets are already discounting lower rates by the end of 2023. Nevertheless, the Fed and ECB may err on the side of caution and proceed cautiously in easing their policy rates amid tight labour markets and resilient wage growth. Global growth in 2024 is set to moderately slow down versus 2023; however, the global economy seems increasingly well-positioned to avoid a recession.

In this context and in line with the priorities set out in the Lifetime Partner 24: Driving Growth plan, in the Life segment the Group continues to execute its strategy to rebalance the Life portfolio to further increase profitability and allocate capital more efficiently. It will also maintain its focus on product simplification and innovation, with the introduction of a range of modular product solutions that are designed to meet customer needs and are marketed through the most suitable and efficient distribution channels. Primary focus areas include protection and health, as well as capital-light savings.

In the Property & Casualty segment, the Group's objective is to maximize profitable growth - with a focus on the non-motor line - across the insurance markets in which it operates, strengthening its position and offering especially in countries with high growth potential.

The Group confirms and strengthens its adaptive approach towards tariff adjustments, also considering the increase in reinsurance coverage costs due to the increased natural catastrophe claims in recent years. The growth of the P&C segment will continue with the aim to enhance its leadership in the European insurance market for private individuals, professionals and small and medium-sized enterprises (SMEs) and also thanks to the recent acquisition of Liberty Seguros, operating in Spain, Portugal and Ireland.

In the Asset & Wealth Management segment, Asset Management will continue to implement its strategy with the objectives of expanding the product offering, particularly in real and private assets, enhancing distribution capabilities, and extending its presence in new markets. This strategy will also be supported by the acquisition of Conning Holdings Limited and its affiliates, which is expected to be completed by the first half of 2024. In Wealth Management, the Banca Generali group will continue to focus on its targets of size, profitability and shareholders’ remuneration as outlined in its strategic plan.

With reference to the Group’s investment policy, it will continue to pursue an asset allocation strategy aimed at ensuring consistency with liabilities to policyholders and, where possible, at increasing current returns.

The Group confirms its commitment to pursue sustainable growth, enhance its earnings profile and lead innovation. This is in order to achieve a compound annual growth rate in earnings per share8 between 6% and 8% in the period 2021-2024, generate Net Holding Cash Flow9 exceeding € 8.5 billion in the period 2022-2024 and distribute cumulative dividends to shareholders for an amount between € 5.2 billion and € 5.6 billion in the period 2022-2024, with a ratchet policy on the dividend per share. The Group expects to achieve the latter target by May 2024: more specifically, based on the assumption that the Shareholders’ Meeting on 24 April 2024 will approve the proposal of distributing dividends in 2024 for € 2.0 billion, cumulative dividends in the period 2022-2024 will be € 5.5 billion.

Generali's sustainability commitment

Sustainability is the originator of the Generali’s Lifetime Partner 24: Driving Growth strategy.

The 2023 Group achievements include:

- As responsible investor, € 9.1 billion of new green and sustainable investments (2021-2023)

- As responsible insurer, € 20.8 billion of premiums from insurance solutions with ESG components10

- As responsible employer, 68% (+33 p.p. vs 2022) of upskilled employees and 35% (+5 p.p. vs 2022) of women in strategic positions

- As responsible corporate citizen, through the global initiatives of The Human Safety Net, the initiatives extended in 26 countries (+8,3% vs 2022) with 77 NGO partners

- Within the sustainable financial management, the successful placement of its fourth and fifth green bonds, for a total value of € 1 billion.

Share capital increase resolution in implementation of the Long Term Incentive Plan 2019-2021

The Board of Directors also approved a capital increase of € 387,970.87 to implement the ‘Group Long Term Incentive Plan (LTIP) 2019-2021’, having ascertained the occurrence of the conditions on which it was based. The execution of the resolution of the Board is subject to the authorisation of the related amendments to the articles of association by IVASS.

Share capital increase resolution in implementation of the Long Term Incentive Plan 2021-2023

The Board of Directors also approved a capital increase of € 9,700,477.94 to implement the ‘Group Long Term Incentive Plan (LTIP) 2021-2023’, having ascertained the occurrence of the conditions on which it was based. The execution of the resolution of the Board is subject to the authorisation of the related amendments to the articles of association by IVASS.

Proposal for Long Term Incentive Plan 2024-2026

Furthermore, the Board of Directors resolved to submit to the approval of the Annual General Meeting the proposal related to the ‘Group Long Term Incentive Plan (LTIP) 2024-2026’, supported by buyback programme for the purposes of the plan.

Significant events after 31 December 2023

Significant events that occurred following the end of the period are available in the Annual Integrated Report and Consolidated Financial Statements 2023.

The Report also contains the description of the alternative performance indicators and the Glossary.

Q&A conference call

The Group CEO, Philippe Donnet, the Group General Manager, Marco Sesana and the Group CFO, Cristiano Borean will host the Q&A session conference call for the consolidated results of the Generali Group as of 31 December 2023, which will be held on 12 March 2024, at 12.00 pm CET.

To follow the conference call, in a listen only mode, please dial +39 02 8020927.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

Generali Q42023 results

Further information by segment

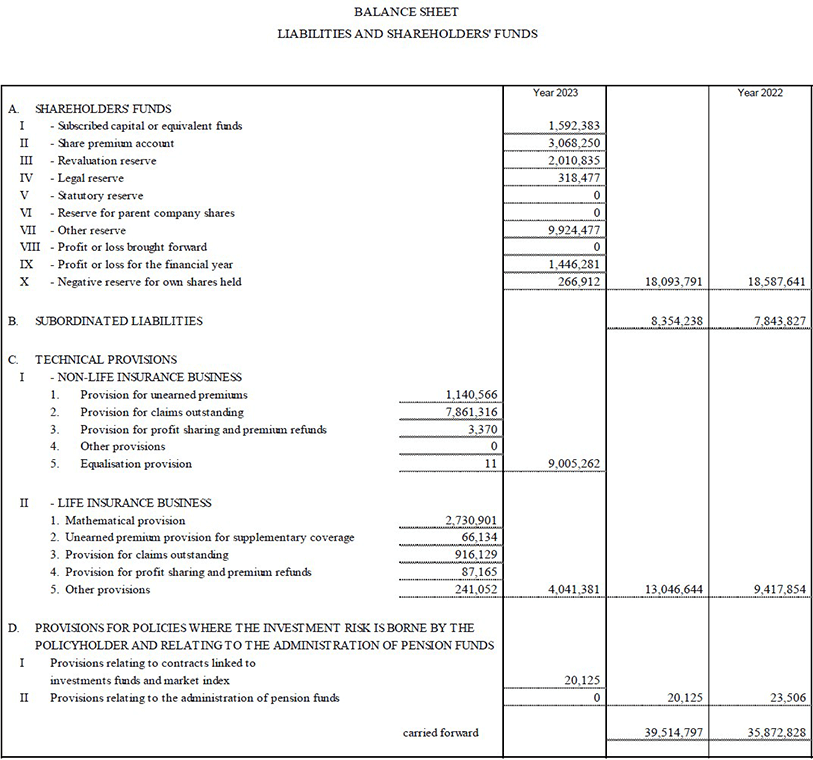

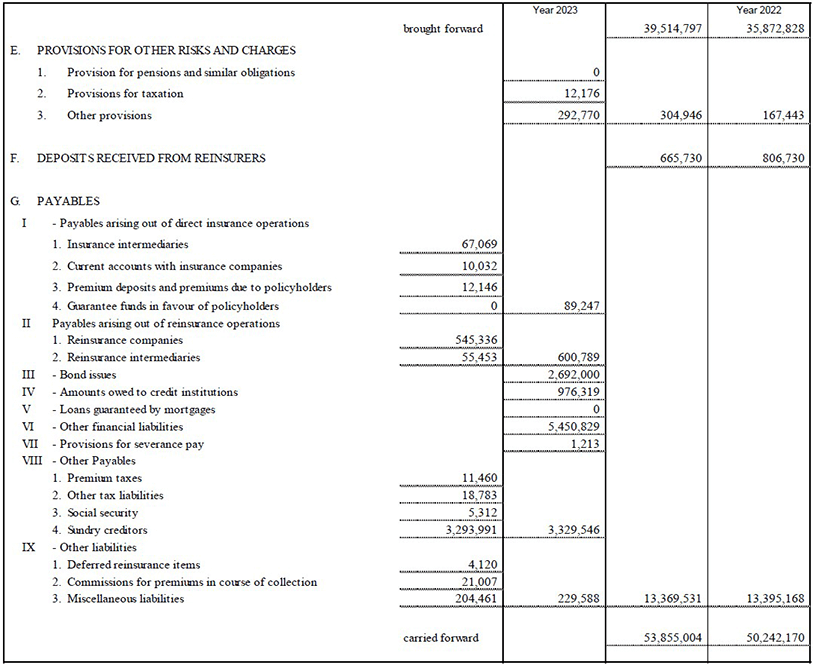

Balance sheet (11)

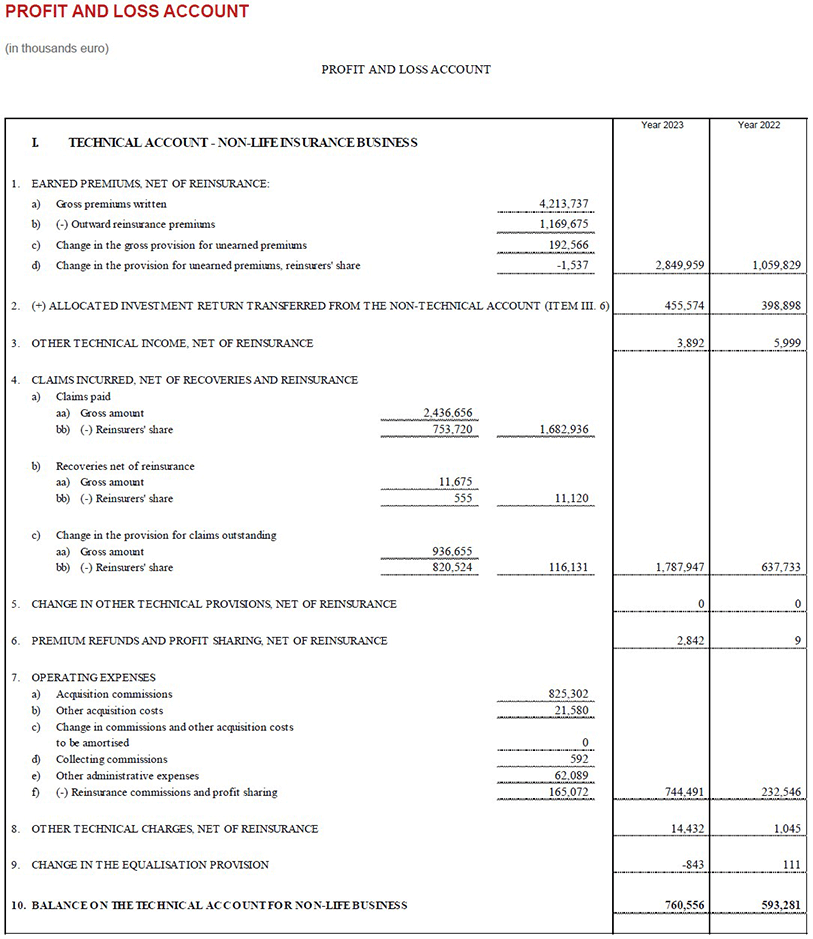

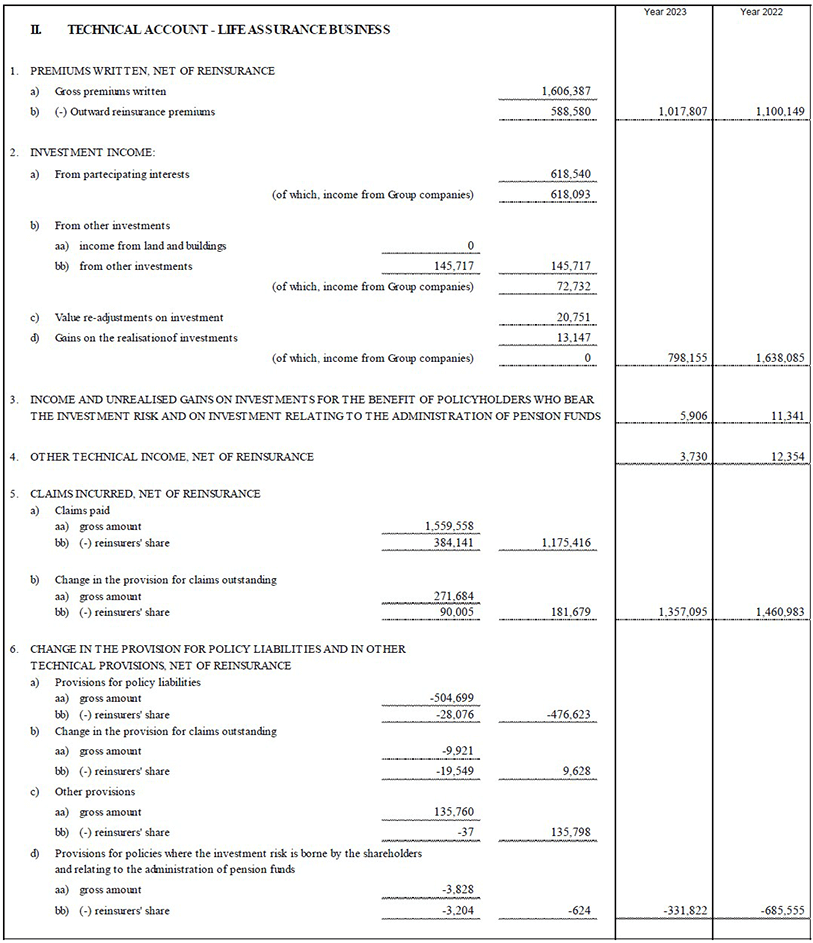

Income statement

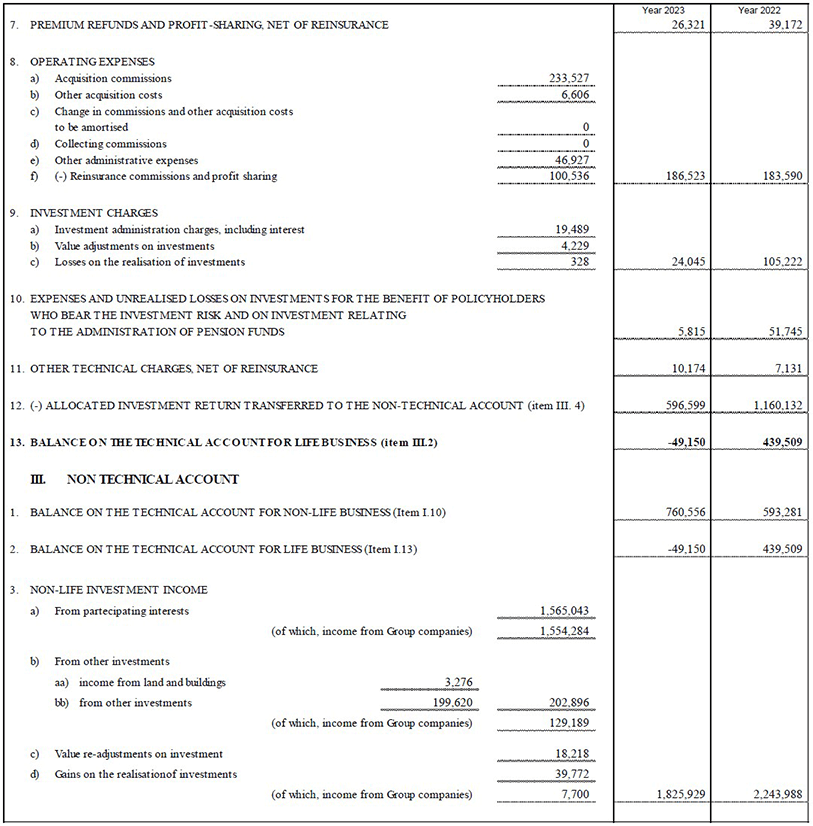

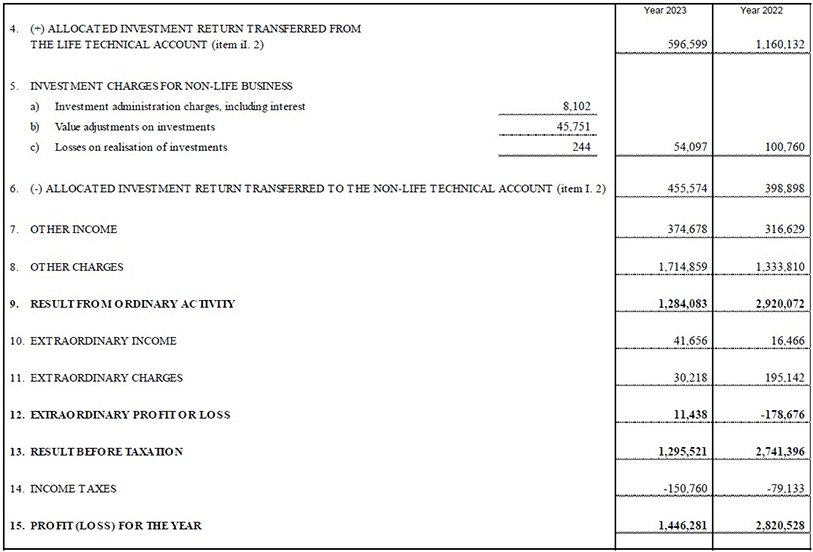

Parent company’s balance sheet and income statement (12)

1 Starting from 1Q2023 the bancassurance JVs of Cattolica (Vera and BCC companies) are considered a ‘disposal group held for sale’ under IFRS 5 and therefore their results are reclassified in the ‘Result of discontinued operations’. Consequently, the Group FY2022 results presented last year have been restated. The ‘result of discontinued operations’ amounted to € 84 million (€ -93 million FY2022).

Changes in premiums, Life net inflows and new business were presented on equivalent terms (at constant exchange rates and consolidation scope). The amounts were rounded and may not add up to the rounded total in all cases. Also the percentages presented can be affected by the rounding.

2Adjusted net result and EPS definitions include adjustments for 1) profit or loss on assets at fair value through profit or loss (FVTPL) on non-participating business and shareholders’ funds, 2) hyperinflation effect under IAS 29, 3) amortisation of intangibles related to M&A, if material; 4) impact of gains and losses from acquisitions and disposals, if material. The EPS calculation is based on a weighted average number of 1,541,766,041 shares outstanding and is excluding weighted average treasury shares equal to 25,592,377.

3 Dividend expressed in cash view. The proposed dividend per share to be submitted to the AGM approval.

4 I.e., excluding nat-cat.

5 For definition of the adjusted net result, please refer to note 2 on page 1.

6 Including premiums from investment contracts equal to € 1,383 million (€ 1,232 million FY2022).

7 € 33 million in Holding Operating Expenses at FY2023 were related to Asset and Wealth Management (€ 31 million at FY2022). Starting from 1Q2024, these expenses will be shown within the Asset and Wealth Management segment.

8 3 year CAGR based on 2024 Adjusted EPS (according to IFRS 17/9 accounting standards and Adjusted net result definition currently adopted by the Group), versus 2021 Adjusted EPS (according to IFRS 4 accounting standards and Adjusted net result definition adopted by the Group until 2022).

9 Net Holding Cash Flow and dividend expressed on cash basis (i.e. cash flows are reported under the year of payment).

10 Insurance solutions with ESG components is a definition used for internal identification purposes.

11 With regard to the financial statements envisaged by law, note that the statutory audit on the data has not been completed. The Group will publish the final version of the Consolidated Half-Yearly Financial Report 2023 in accordance with prevailing law, also including the Independent Auditor’s Report. In compliance with IFRS8, it should be noted that, following the changes introduced by the application of the new IFRS9 and IFRS17, comparative data in the financial statements have been appropriately restated.

12 With regard to the financial statements envisaged by law, note that the statutory audit on the data has not been completed. The Group will publish the final version of the Proposal of Management Report and Financial Statements of Parent Company 2022 in accordance with prevailing law. In compliance with IFRS8, it should be noted that, following the changes introduced by the application of the new IFRS9 and IFRS17, comparative data in the financial statements have been appropriately restated.